Difference between revisions of "Independent contractor"

| Line 1: | Line 1: | ||

| − | [[File:Contracting.png|400px|thumb|right|[[Independent contractor]]]][[File:Employee-vs-contractor.png|400px|thumb|right|[[Independent contractor]] vs [[employee]]]]An [[independent contractor]] (in the [[United States]], also known as [[1099-form worker]]; hereinafter, the ''Contractor'') is a [[legal entity]], either an individual or [[organization]], that provides goods or services to another [[legal entity]] under terms specified in a [[contract]] or within a verbal agreement. Unlike an [[employee]], the ''Contractor'' does not work regularly for an [[employer]], but works as and when required, during which time he or she may be subject to law of agency. The ''Contractors'' are usually paid on a freelance basis. The ''Contractors'' often work through a limited company or franchise, which they themselves own, or may work through an umbrella organization. | + | [[File:Contracting.png|400px|thumb|right|[[Independent contractor]]]][[File:Employee-vs-contractor.png|400px|thumb|right|[[Independent contractor]] vs [[employee]]]][[File:Org-struct.png|400px|thumb|right|[[Functional structure]]]]An [[independent contractor]] (in the [[United States]], also known as [[1099-form worker]]; hereinafter, the ''Contractor'') is a [[legal entity]], either an individual or [[organization]], that provides goods or services to another [[legal entity]] under terms specified in a [[contract]] or within a verbal agreement. Unlike an [[employee]], the ''Contractor'' does not work regularly for an [[employer]], but works as and when required, during which time he or she may be subject to law of agency. The ''Contractors'' are usually paid on a freelance basis. The ''Contractors'' often work through a limited company or franchise, which they themselves own, or may work through an umbrella organization. |

==Related lectures== | ==Related lectures== | ||

Revision as of 19:48, 2 November 2019

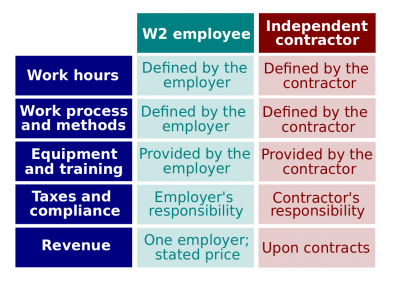

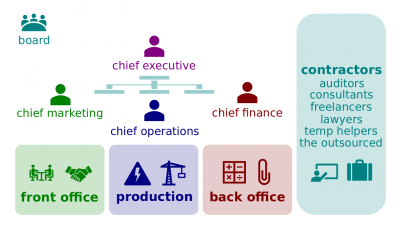

An independent contractor (in the United States, also known as 1099-form worker; hereinafter, the Contractor) is a legal entity, either an individual or organization, that provides goods or services to another legal entity under terms specified in a contract or within a verbal agreement. Unlike an employee, the Contractor does not work regularly for an employer, but works as and when required, during which time he or she may be subject to law of agency. The Contractors are usually paid on a freelance basis. The Contractors often work through a limited company or franchise, which they themselves own, or may work through an umbrella organization.