College Accounting: A Practical Approach by Slater (13th edition)

College Accounting: A Practical Approach by Slater (13th edition) is the 13th edition of the college textbook that is titled College Accounting: A Practical Approach, has been written by Jeffrey Slater and published by Pearson Education, Inc. Vaughn College of Aeronautics and Technology utilizes this textbook for its Vaughn College MGT120 course.

Contents

- 1 Accounting Concepts and Procedures (Chapter 1)

- 2 Debits and Credits: Analyzing and Recording Business Transactions (Chapter 2)

- 3 Beginning the Accounting Cycle (Chapter 3)

- 4 The Accounting Cycle Continued (Chapter 4)

- 5 The Accounting Cycle Completed (Chapter 5)

- 6 Banking Procedures and Control of Cash (Chapter 6)

- 7 Calculating Pay and Recording Payroll Taxes: The Beginning of the Payroll Process (Chapter 7)

- 8 Paying the Payroll, Depositing Payroll Taxes, and Filing the Required Quarterly and Annual Tax Forms: The Conclusion of the Payroll Process (Chapter 8)

- 9 Sales and Cash Receipts (Chapter 9)

- 10 Purchases and Cash Payments (Chapter 10)

- 11 Preparing a Worksheet for a Merchandise Company (Chapter 11)

- 12 Completion of the Accounting Cycle for a Merchandise Company (Chapter 12)

- 13 Accounting for Bad Debts (Chapter 13)

- 14 Notes Receivable and Notes Payable (Chapter 14)

- 15 Accounting for Merchandise Inventory (Chapter 15)

- 16 Accounting for Property, Plant, Equipment, and Intangible Assets (Chapter 16)

- 17 Partnership (Chapter 17)

- 18 Corporations: Organizations and Stock (Chapter 18)

- 19 Corporations: Stock Values, Dividends, Treasury Stocks, and Retained Earnings (Chapter 19)

- 20 Corporations and Bonds Payable (Chapter 20)

- 21 Statement of Cash Flows (Chapter 21)

- 22 Analyzing Financial Statements (Chapter 22)

- 23 The Voucher System (Chapter 23)

- 24 Departmental Accounting (Chapter 24)

- 25 Manufacturing Accounting (Chapter 25)

Accounting Concepts and Procedures (Chapter 1)

Chapter 1 definitions

- Accounting. A system that measures the business' activities in financial terms, provides written reports and financial statements about those activities, and communicates these reports to decision makers and others.

- Sole proprietorship. A type of business organization that has one owner. This owner is personally liable for paying the business' debt.

- Partnership. A form of business organization that has at least two owners. The partners usually are generally liable for the partnership's debts.

- Corporation. A form of business organization that is owned by stockholders. Stockholders usually are not personally liable for the corporation's debts.

- Limited liability company. A form of business organization that is owned by one or more members. Members are only liable to the extent of their investments.

- Service company. An enterprise that provides one or more services.

- Merchandise company. An enterprise that makes its own products or buys a product from a manufacturer to sell to customers.

- Manufacturer. An enterprise that makes a product and sells it to its customers.

- Generally Accepted Accounting Principles (GAAP). The procedures and guidelines that must be followed during the accounting process.

- International Financial Reporting Standards. A group of accounting standards and procedures that if adopted by the United States could replace GAAP.

- Bookkeeping. The recording function of the accounting process.

- Assets. Properties (resources) of value such as cash, supplies, equipment, or land owned by an organization.

- Equities. The rights of financial claims of creditors (liabilities) and owners (owner's equity) who supply the assets to an organization.

- Liabilities. Obligations that come due in the future. Liabilities are the financial rights or claims of creditors to assets.

- Creditor. Anyone who has a claim to assets.

- Owner's equity. Rights of financial claims to the assets of an organization. In the basic accounting equation, assets minus liabilities).

- Basic accounting equation. Assets = Liabilities + Owner's equity.

- Capital. The owner's investment of equity in the organization.

- Supplies. The type of assets acquired by an organization that has a much shorter life than equipment.

- Shift in assets. A shift that occurs when the composition of the assets has changed but the total of the assets remains the same.

- Accounts payable. Amounts owed to creditors that result from the purchase of goods or services on account -- a liability.

- Balance sheet (also known as statement of financial position). A financial statement, as of a particular date, that shows the amount of assets owned by an organization as well as the amount of claims (liabilities and owner's equity) against these assets.

- Cash basis. An accounting system that records revenue when cash is received and expenses when paid. This system does not match revenues and expenses like in the accrual basis of accounting.

- Accrual basis. An accounting system that matches revenues when earned with expenses that are incurred.

- Revenue. An amount earned by performing services for customers or selling goods to customers; it can be in the form of cash or accounts receivable. Revenue is a subdivision of owner's equity: As revenue increases, owner's equity increases.

- Accounts receivable. An asset that indicates the amount owed by customers.

- Expenses. A cost incurred in running a business by consuming goods or services in producing revenue. Expenses is a subdivision of owner's equity.

- Net income. The financial result of operations when revenue totals more than expenses.

- Net loss. The financial result of operations when expenses total more than revenue.

- Withdrawals. A subdivision of owner's equity that records money or other assets an owner withdraws from a business for personal use.

- Expanded accounting equation. Assets = Liabilities + Owner's Capital - Owner's Withdrawals + Revenue - Expenses.

- Income statement. An accounting statement that details the performance of an organization (revenue minus expenses) for a specific period of time.

- Statement of owner's equity. A financial statement that reveals the change in capital. The ending figure for capital is then placed on the balance sheet.

- Ending capital. Beginning Capital + Additional Investments + Net income - Owner's Withdrawals = Ending Capital. Or Beginning Capital + Additional Investments - Net loss - Owner's Withdrawals = Ending Capital

Chapter 1 summary problem

- Data. Michael Brown opened his law office on June 1, 2018. During the first month of operation, Michael conducted the following transactions:

- Invested $6,000 in cash in law practice.

- Paid $600 for office equipment.

- Purchased additional office equipment on account, $1,000.

- Received cash for performing legal services for clients, $2,000.

- Paid salaries, $800.

- Performed legal services for clients on account, $1,000.

- Paid rent, $1,200.

- Withdrew $500 from his law practice for personal use.

- Received $500 from customers in partial payment for legal services performed in transaction (6).

- Requirements:

- Record these transactions in the expanded accounting equation.

- Prepare the financial statements at June 30 for Michael Brown, Attorney-at-Law.

Debits and Credits: Analyzing and Recording Business Transactions (Chapter 2)

Chapter 2 definitions

- Account. An accounting device used in bookkeeping to record increases and decreases of business transactions relating to individual assets, liabilities, capital, Owner's Withdrawals, revenue, expenses, and so on.

- Standard account. A formal account that includes columns for date, explanation, posting reference, debit, and credit.

- Ledger. A group of accounts that records data from business transactions.

- T account. A skeleton version of a standard account, used for demonstration purposes.

- Debit. The left-hand side of any account. A number entered on the left side of any account is said to be debited to an account.

- Credit. The right-hand side of any account. A number entered on the right side of any account is said to be credited to an account.

- Footings. The totals of each side of a T account.

- Ending balance. The difference between footings in a T account.

- Normal balance of an account. The side of an account that increases by the rules of debit and credit.

- Chart of accounts. A numbering system of accounts that lists the account titles and account numbers to be used by an organization.

- Compound entry. A transaction involving more than one debit or credit.

- Double-entry bookkeeping. An accounting system in which the recording of each transaction affects two or more accounts and the total of the debits is equal to the total of the credits.

- Trial balance. A list of the ending balances of all the accounts in a ledger. The total of the debits should equal the total of the credits. Alternatively, trial balance can be defined as an informal listing of the ledger accounts and their balances in the ledger to aid in providing the equality of debits and credits.

Chapter 2 summary problem

- Data. Mel's Delivery Service is a sole proprietorship. Its available data is as follows:

Mel's Delivery Service's chart of accounts To be used in Category Account code Account name Balance sheet Assets 111 Cash 112 Accounts Receivable 121 Office Equipment 122 Delivery Trucks Liabilities 211 Accounts Payable Owner's Equity 311 Mel Free, Capital 312 Mel Free, Withdrawals 313 Income Summary Income statement Revenue 411 Delivery Fees Earned Expenses 511 Salaries Expense 512 Advertising Expense 513 Gas Expense 514 Office Supplies Expense 515 Telephone Expense - The following transactions resulted for Mel's Delivery Service during the month of July of 2018:

Mel's Delivery Service's operations, July of 2018 Transaction date Transaction reference Transaction description July 1 A Mel invested $10,000 in the business from his personal savings account July 5 B Bought delivery trucks on account, $17,000 July 9 C Advertising bill received but unpaid, $700 July 12 D Bought office equipment for cash, $1,200 July 19 E Received cash for delivery services rendered, $15,000 July 21 F Paid salaries expense, $3,000 July 22 G Paid gas expense for company trucks, $1,250 July 25 H Billed customers for delivery services rendered, $4,000 July 26 I Paid telephone bill, $300 July 27 J Received $3,000 as partial payment of transaction H July 29 K Mel paid home telephone bill from company checkbook, $150

- Requirements:

- As Mel's newly employed accountant, you must do the following:

- Set up T accounts in a ledger.

- Record transactions in the T accounts (please place the letter of the transaction next to the entry).

- Foot and take the balance of each account where appropriate.

- Prepare a trial balance at the end of July.

- Prepare from the trial balance, in a proper form, (a) an income statement for the month of July, (b) a statement of owner's equity, and (c) balance sheet as of July 31st, 2018.

Beginning the Accounting Cycle (Chapter 3)

Chapter 3 definitions

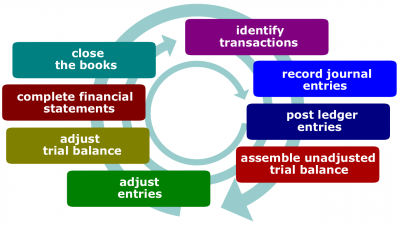

- Accounting cycle. For each accounting period, the process that begins with the recording of business transactions or procedures into a general journal and ends with the completion of a post-closing trial balance.

- Accounting period. The period of time for which an income statement is prepared.

- Interim report. A fiscal statement that is prepared for a month, quarter, or some other portion of the fiscal year.

- Journal (alternatively known as general journal). A listing of business transactions in chronological order. The journal links on one page the debit and credit parts of transactions.

- Journal entry. The transaction (debits and credits) that is recorded into a general journal once it is analyzed.

- Journalizing. The process of recording a transaction into the general journal.

- Book of original entry. Book that records the first formal information about business transactions. A general journal is an example of a book of original entry.

- Book of final entry. Book that records information about business transactions from a book of original entry such as a general journal. A ledger is an example of a book of final entry.

- Compound journal entry. A journal entry that affects more than two accounts.

- Posting. The transferring, copying, or recording of information from a general journal to a ledger.

- Four-column account. A running balance account that records debits and credits and has a column for an ending balance (debit or credit). It replaces the standard two-column account we used earlier.

- Cross-referencing. Adding to the PR column of the journal the account number of the ledger account that was upgraded from the general journal.

- Slide. The error that results in adding or deleting zeros in the writing of a number such as 79,200 instead of 7,920.

- Transposition. The accidental rearrangement of digits of a number such as 152 instead of 125.

Chapter 3 summary problem

- Data. In March of 2018, Abby's Employment Agency had the following transactions:

Abby's Employment Agency's operations, March of 2018 Transaction date Transaction reference Transaction description March 1 A Abby Todd invested $5,000 cash in the new employment agency. March 4 B Bought equipment for cash, $200. March 5 C Earned employment fee commission, $200, but payment from Blue Co. will not be received until June. March 6 D Paid wages expense, $300. March 7 E Abby paid her home utility bill from the company checkbook, $75. March 9 F Placed Rick Wool at VCR Corporation, receiving $1,200 cash. March 15 G Paid cash for supplies, $200. March 28 H Telephone bill received but not paid, $180. March 29 I Advertising bill received but not paid, $400.

- The chart of accounts includes Cash, 111; Accounts Receivable, 112; Supplies, 131; Equipment, 141; Accounts Payable, 211; A. Todd, Capital, 311; A. Todd, Withdrawals, 321; Employment Fees Earned, 411; Wage Expense, 511; Telephone Expense, 521; and Advertising Expense, 531.

- Requirements: Your tasks are to do the following:

- Journalize business transactions in the General Journal (all page 1).

- Set up a ledger based on the chart of accounts.

- Post journal entries.

- Prepare a trial balance for March 31.

The Accounting Cycle Continued (Chapter 4)

Chapter 4 definitions

- Worksheet. A columnar device used by accountants to aid them in completing the accounting cycle -- often just referred to as spreadsheet. It is not a formal report.

- Adjusting. The process of calculating the latest up-to-date balance of each account at the end of an accounting period.

- Historical cost. The actual cost of an asset at time of purchase.

- Depreciation. The allocation (spreading) of the cost of an asset such as an auto or equipment over its expected useful life.

- Residual value. Estimated value of an asset after all the allowable depreciation has been taken.

- Accumulated Depreciation. A contra-asset account that summarizes or accumulates the amount of depreciation that has been taken on an asset.

- Book value. Cost of equipment less accumulated depreciation.

- Accrued salaries payable. Salaries that are earned by employees but unpaid and unrecorded during the period (and thus need to be recorded by an adjustment) and will not come due for payment until the next accounting period.

Chapter 4 summary problem

- Data. From the following trial balance and adjustment data, complete (1) a worksheet and (2) the three financial statements (numbers are intentionally small so you may concentrate on the theory).

Frost Company, Trial Balance, December 31, 2018 Account code Account name Dr. Cr. 111 Cash 14 112 Accounts Receivable 4 130 Prepaid Insurance 5 151 Plumbing Supplies 3 157 Plumbing Equipment 7 158 Accumulated Depreciation, Plumbing Equipment 5 201 Accounts Payable 1 300 J. Frost, Capital 12 301 J. Frost, Withdrawals 3 410 Plumbing Fees 27 726 Salaries Expense 5 729 Rent Expense 4 Totals 45 45

- Adjustment Data:

- Insurance Expired, $3.

- Plumbing Supplies on hand, $1.

- Depreciation Expense, Plumbing Equipment, $1.

- Salaries owed but not paid to employees, $2.

- Requirements:

- Prepare a worksheet

- Prepare financial statements for month of December

The Accounting Cycle Completed (Chapter 5)

Chapter 5 definitions

- Adjusting journal entries. Journal entries that are needed in order to update specific ledger accounts to reflect correct balances at the end of an accounting period.

- Permanent account (also known as real account). An account, such as Assets, Liabilities, and Owner's Capital, whose balances are carried over to the next accounting period.

- Temporary account (also known as nominal account). An account whose balances at the end of an accounting period are not carried over to the next accounting period.

- Closing journal entry. A journal entry that is prepared to (a) reset all temporary accounts to a zero balance and (b) update Owner's Capital to a new balance.

- Income Summary. A temporary account in the ledger that summarizes revenue and expenses and transfers the balance (either net income or net loss) to Owner's Capital. This account does not have a normal balance (i.e., it could have a debit or a credit balance.

- Post-closing trial balance. The final step in the accounting cycle that lists only permanent accounts in the ledger and their balances after adjusting and closing entries have been posted.

Chapter 5 summary problem

- Data. Rolo Company is a sole proprietorship. Its available data is as follows:

Rolo Company's chart of accounts To be used in Category Account code Account name Balance sheet Assets 111 Cash 112 Accounts Receivable 114 Prepaid Rent 115 Office Supplies 121 Office Equipment 122 Accumulated Depreciation, Office Equipment Liabilities 211 Accounts Payable 212 Salaries Payable Owner's Equity 311 R. Kern, Capital 312 R. Kern, Withdrawals 313 Income Summary Income statement Revenue 411 Fees Earned Expenses 511 Salaries Expense 512 Advertising Expense 513 Rent Expense 514 Office Supplies Expense 515 Depreciation Expense, Office Equipment

- The following transactions resulted for Rolo Company during the month of January of 2019:

Rolo Company's operations, January of 2019 Transaction date Transaction reference Transaction description January 1 A Rolo Kern invested $1,200 cash and $100 of office equipment to open Rolo Co. January 1 B Paid rent for 3 months in advance, $300. January 4 C Purchased office equipment on account, $50. January 6 D Bought office supplies for cash, $40. January 8 E Collected $400 for services rendered. January 12 F Rolo paid his home electric bill from the company checkbook, $20. January 14 G Provided $100 worth of services to clients who will not pay until next month. January 16 H Paid salaries, $60. January 18 I Advertising bill received for $70 but will not be paid until next month.

- We will use unusually small numbers to simplify calculation and emphasize the theory.

- Adjustment data on January 31:

- Supplies on hand, $6.

- Rent expired, $100.

- Depreciation, Office Equipment, $20.

- Salaries accrued, $50

- Requirements:

- Journalize transactions and post to ledger.

- Prepare a worksheet.

- Prepare financial statements.

- Journalize adjusting and closing entries and prepare a post-closing trial balance.

Banking Procedures and Control of Cash (Chapter 6)

- Internal control system. Procedures and methods to control an organization's assets as well as monitor its operations.

- Signature card. A form signed by a bank customer that the bank uses to verify signature authenticity on all checks.

- Deposit slip. A form provided by a bank for use in depositing money or checks into a checking account.

- Endorsement. A payee's signature on a check. When endorsement is blank, a check could be further endorsed. When endorsement is executed (its field is full), this endorsement restricts further endorsement to only the person or organization named. When endorsement is restrictive, this endorsement restricts any further endorsement.

- Check. A form used to indicate a specific amount of money that is to be paid by the bank to a named person or organization.

- Drawer. A person who writes a check.

- Drawee. A bank that the drawer has an account with.

- Payee. The person or organization to whom the check is payable.

- Cancelled check. A check that has been processed by a bank and is no longer negotiable.

- Bank reconciliation. The process of reconciling the checkbook balance with the bank balance given on the bank statement.

- Bank statement. A financial report sent by a bank to a customer indicating the previous balance, ATM transactions, nonsufficient funds, individual checks processed, individual deposits received, service charges, and ending bank balance.

- Deposit in transit. Deposits that were made by customers of a bank but did not reach, or were not processed by the bank before the preparation of the bank statement.

- Outstanding check. A check written by an organization or person that were not received or not processed by the bank before the preparation of the bank statement.

- Nonsufficient funds (NSF). Notation indicating that a check has been written on an account that lacks sufficient funds to back it up.

- Debit memorandum. Decrease in depositor's balance.

- Credit memorandum. Increase in depositor's balance.

- Electronic funds transfer. An electronic system that transfers funds without the use of paper checks.

- ATM (automatic teller machine). Machine that allows for depositing, withdrawal, and advanced banking transactions.

- Phishing. Fake emails that attempt to obtain information about online banking customers.

- Check truncation (check safekeeping). Procedure whereby checks are not returned to the drawer with the bank statement but are instead kept at the bank for a certain amount of time before being first transferred to image and then destroyed.

- Petty cash fund. Fund (source) that allows payment of small amounts without the writing of checks.

- Petty cash voucher. A petty cash form to be completed when money is taken out of petty cash.

- Auxiliary petty cash record. A supplementary record for summarizing petty cash information.

- Cash Short and Over. The account that records cash shortages and overages. If the ending balance is a debit

Calculating Pay and Recording Payroll Taxes: The Beginning of the Payroll Process (Chapter 7)

- Fair Labor Standards Act (Federal Wage and Hour Law). A United States law that the majority of American employers must follow that contains rules stating the minimum hourly rate of pay and the maximum number of hours a worker will work before being paid time and a half for overtime hours worked. This law also has other rules and regulations that employers must follow for payroll purposes.

- Interstate commerce. A test that is applied to determine whether an employer must follow the rules of the Fair Labor Standards Act. If an employer communicates or does business with another business in some other state, it is usually considered to be involved in interstate commerce.

- Pay period (payroll period). A length of time used by an employer to calculate the amount of an employee's earnings. Pay periods can be daily, weekly, biweekly (once every 2 weeks), semimonthly (twice each month), monthly, quarterly, or annually.

- Gross earnings (gross pay). All earnings before any deductions.

- Workweek. A 7-day (168-hour) period used to determine overtime hours for employees. A workweek can begin on any given day, but must end 7 days later.

- Form W-4 (Employee's Withholding Allowance Certificate). A form filled out by employees and used by employers to supply needed information about the number of allowances claimed, marital status, and so forth. The form is used for payroll purposes to determine federal income tax withholding from an employee's paycheck.

- Federal income tax withholding (FIT withholding). Amount of federal income tax withheld by the employer from the employee's gross pay; the amount withheld is determined by the employee's gross pay, the pay period, the number of allowances claimed by the employee on the W-4 form, and the marital status indicated on the W-4 form.

- Allowances (also known as exemptions). Certain dollar amounts of a person's income tax that will be considered nontaxable for income tax withholding purposes.

- Wage bracket table. One of various charts in IRS Circular E that provide information about deductions for federal income tax based on earnings and data supplied on the W-4 form.

- IRS Circular E (Circular E). An IRS tax publication of payroll procedures, including tax tables.

- State income tax withholding. Amount of state income tax withheld by the employer from the employee's gross pay.

- Calendar year. A 1-year period beginning on January 1 and ending on December 31. In United States, employers must use a calendar year for payroll purposes, even if the employer uses a fiscal year for financial statements and for any other reason.

- FICA (Federal Insurance Contributions Act). Part of the Social Security Act of 1935, this law taxes both the employer and employee up to a certain maximum rate and wage base for OASDI tax purposes. It also taxes both the employer and employee for Medicare purposes, but this tax has no wage base maximum.

- Taxable earnings. A numerical value that shows amount of earnings subject to a tax. The tax itself is not shown.

- Medical insurance. Health care insurance for which premiums may be paid through a deduction from an employee's paycheck.

- Net pay. Gross earnings, less deductions. Net pay, or take-home pay, is what the worker actually takes home.

- Payroll register. A multicolumn form that is used to record payroll data.

- Individual employee earnings record. An accounting document that summarizes the total amount of wages paid and the deductions for the calendar year. It aids in preparing governmental reports. A new record is prepared for each employee each year.

- Federal Unemployment Tax Act (FUTA). A tax paid by employers to the federal government. The current rate is 0.6% on the first $7,000 of earnings of each employee after the normal FUTA tax credit is applied.

- State Unemployment Tax Act (SUTA). A tax usually paid only by employers to the state for employee unemployment insurance.

- Workers' compensation insurance. Insurance purchased by most employers to protect their employees against losses due to injury or death while on the job.

- Experience rating (merit rating). A rate assigned by an insurance company to determine the cost of insurance coverage. This rate is based on the physical difficulty of jobs within various industries and the history/cost of prior employee accident claims submitted.

- Payroll tax expense. The cost to employers that includes the total of the employer's FICA OASDI, FICA Medicare, FUTA, and SUTA taxes. Remember, the employer matches the employee contributions for OASDI and Medicare.

Paying the Payroll, Depositing Payroll Taxes, and Filing the Required Quarterly and Annual Tax Forms: The Conclusion of the Payroll Process (Chapter 8)

- Employer identification number (EIN). A number assigned by the IRS that is used by an employer when recording and paying payroll and income taxes.

- Form SS-4. The form filled out by an employer to get an EIN. The form is sent to the IRS, which assigns the number to the business.

- Form 941 tax. Another term used to describe FIT, OASDI, and Medicare. This name comes from the form used to report these taxes.

- Look-back period. A period of time used to determine whether a business should make its Form 941 tax deposits on a monthly or semiweekly basis. The IRS defines this period as July 1 through June 30 of the year prior to the year in which Form 941 tax deposits will be made.

- Monthly depositor. A business classified as a monthly depositor will make its payroll tax deposits only once each month for the amount of Form 941 taxes due from the prior month.

- Semiweekly depositor. A business classified as a semiweekly depositor may have to make its payroll tax deposits up to twice in one week, depending on when payroll is paid.

- Banking day. Any day that a bank is open to the public for business. Generally, a banking day will end at 2:00 or 3:00 p.m. local time. Banking business transacted after this time is usually considered to be the next day’s business. Saturdays, Sundays, and federal holidays are usually not considered banking days.

- Form 941 (Employer's Quarterly Federal Tax Return). A tax report that a business will complete after the end of each calendar quarter indicating the total FICA (OASDI and Medicare) taxes owed plus the amount of FIT withheld from employees' pay for the quarter. If federal tax deposits have been made correctly and on time, the total amount deposited should equal the amount due on Form 941. Any difference results in a payment due or a refund.

- Calendar quarter. A three-month, 13-week time period. Four calendar quarters occur during a calendar year that runs from January 1 through December 31. The first quarter is January through March, the second is April through June, the third is July through September, and the fourth is October through December.

- Form 940 (Employer's Annual Federal Unemployment Tax Return). This form is used by employers at the end of the calendar year to report the amount of unemployment tax due for the year. If more than $500 is cumulatively owed at the end of a quarter, it should be paid one month after the end of that quarter. Normally, the report is due January 31 after the calendar year, or February 10 if an employer has already made all deposits.

- Form W-2 (Wage and Tax Statement). A form completed by the employer at the end of the calendar year to provide a summary of gross earnings and deductions to each employee. At least three copies go to the employee, one copy to the IRS, one copy to any state where employee income taxes have been withheld, one copy to the Social Security Administration, and one copy into the records of the business.

- Form W-3 (Transmittal of Wage and Tax Statements). A form completed by the employer to verify the number of W-2s and amounts withheld as shown on them. This form is sent to the Social Security Administration data processing center along with copies of each employee's W-2 forms.

Sales and Cash Receipts (Chapter 9)

- Retailer. A merchant who buy goods from wholesalers for resale to customers.

- Merchandise. Goods brought into a store for resale to customers.

- Sales Returns and Allowances account (SRA account). A contra-revenue account that records price adjustments and allowances granted on merchandise that is defective and has been returned.

- Sales discount. Amount a customer is allowed to deduct from the bill total for paying a bill during the discount period.

- Discount period. A period shorter than the credit period when a discount is available to encourage early payment of bills.

- Credit period. Length of time allowed for payment of goods sold on account.

- Sales Discount account. A contra-revenue account that records cash discounts granted to customers for payments made within a specific period of time.

- Net sales. Gross sales less sales returns and allowances less sales discounts.

- Gross sales. The revenue earned from sale of merchandise to customers.

- Sales Tax Payable account. An account in the general ledger that accumulates the amount of sales tax owed. It has a credit balance.

- Wholesaler. A merchant who buys goods from suppliers and manufacturers for sale to retailers.

- Sales invoice. A bill sent to customer(s) reflecting a credit sale.

- Accounts receivable subsidiary ledger. A book or file that contains the individual records, in alphabetical order, of amounts owed by various credit customers.

- Subsidiary ledger. A ledger that contains accounts of a single type. Example: The accounts receivable subsidiary ledger records all credit customers.

- Accounts Receivable account (Accounts Receivable controlling account). The Accounts Receivable account in the general ledger, after postings are complete, shows a firm the total amount of money owed to it. This figure is broken down in the accounts receivable subsidiary ledger, where it indicates specifically who owes the money.

- Credit memorandum. A piece of paper sent by the seller to a customer who has returned merchandise previously purchased on credit. The credit memorandum indicates to the customer that the seller is reducing the amount owed by the customer.

- Schedule of accounts receivable. A list of the customers, in alphabetical order, that have an outstanding balance in the accounts receivable subsidiary ledger. This total should be equal to the balance of the Accounts Receivable controlling account in the general ledger at the end of the month.

Purchases and Cash Payments (Chapter 10)

- Purchases. Merchandise for resale. It is a cost.

- Purchases Returns and Allowances. A contra-cost account in the ledger that records the amount of defective or unacceptable merchandise returned to suppliers and/or price reductions given for defective items.

- Purchases Discount. A contra-cost account in the general ledger that records discounts offered by vendors of merchandise for prompt payment of purchases by buyers.

- F.O.B. destination. Seller pays or is responsible for the cost of freight to purchaser's location or destination.

- F.O.B. shipping point. Purchaser pays or is responsible for the shipping costs from seller's shipping point to purchaser's location.

- Purchase requisition. A form used within a business by the requesting department asking the purchasing department of the business to buy specific goods.

- Purchase order. A form used in business to place an order for the buying of goods from a seller.

- Purchase invoice. The seller's sales invoice, which is sent to the purchaser.

- Receiving report. A business form used to notify the appropriate people of the ordered goods received along with the quantities and specific condition of the goods.

- Invoice approval form. A form used by the accounting department in checking the invoice and finally approving it for recording and payment.

- Accounts payable subsidiary ledger. A book or file that contains, in alphabetical order, the name of the creditor and amount owed from purchases on account.

- Debit memorandum. A memo issued by a purchaser to a seller, indicating that some Purchases Returns and Allowances have occurred and therefore the purchaser now owes less money on account.

- Controlling account. The account in the general ledger that summarizes or controls a subsidiary ledger. Example: The Accounts Payable account in the general ledger is the controlling account for the accounts payable subsidiary ledger. After postings are complete, it shows the total amount owed from purchases made on account.

- Perpetual inventory system. An inventory system of an organization that keeps a continuous (perpetual) record of each type of inventory by recording units on hand, units sold, cost of goods sold, and the current balance after each sale or purchase.

- Cost of Goods Sold. In a perpetual inventory system, an account that records the cost of goods sold or the cost of merchandise inventory used to make the sale.

- Periodic inventory system. An inventory system that counts inventory only at the end of the accounting period. It also calculates the cost of the unsold goods on hand by taking the cost of each unit times the number of units of each product on hand.

- Merchandise Inventory. An asset and perpetual inventory system account that records purchases of merchandise. Discounts and returns are recorded in this account for the buyer.

Preparing a Worksheet for a Merchandise Company (Chapter 11)

- Cost of goods sold. Total cost of the goods which were sold to customers.

- Beginning merchandise inventory (beginning inventory). The cost of goods on hand in a company to begin an accounting period.

- Ending merchandise inventory (ending inventory). The cost of goods that remain unsold at the end of the accounting period. It is an asset on the new balance sheet.

- Freight-In. A cost of goods sold account that records the shipping cost to the buyer.

- Gross profit. Net sales less cost of goods sold.

- Mortgage Payable. A liability account showing amount owed on a mortgage.

- Interest expense. The cost of borrowing money.

- Unearned Revenue. A liability account that records amount owed for goods or services in advance of delivery. The Cash account would record the receipt of cash.

Completion of the Accounting Cycle for a Merchandise Company (Chapter 12)

- Selling expenses. Operating expenses directly related to the sale of goods excluding Cost of Goods Sold.

- Administrative expenses (general expenses). Operating expenses such as general office expenses that are incurred indirectly in the selling of goods.

- Other income. Any revenue other than revenue from sales and service revenue. It appears in a separate section on the income statement. Examples: Rental Income and Storage Fees.

- Other expenses. Nonoperating expenses that do not relate to the main operating activities of the business; they appear in a separate section on the income statement. One example given in the text is Interest Expense, interest owed on money borrowed by the company.

- Classified balance sheet. A balance sheet that categorizes assets as current assets or plant and equipment and groups liabilities as current or long-term liabilities.

- Current assets. Assets that can be converted into cash or used within 1 year or the normal operating cycle of the business, whichever is longer.

- Operating cycle. Average time it takes to buy and sell merchandise and then collect accounts receivable.

- Plant and equipment. Long-lived assets such as equipment, buildings, or land that are used in the production or sale of goods or services.

- Current liabilities. Obligations that will come due within 1 year or within the operating cycle, whichever is longer.

- Long-term liabilities. Obligations that are not due or payable for a long time, usually for more than a year.

- Reversing entries. Optional bookkeeping technique in which certain adjusting entries are reversed or switched on the first day of the new accounting period so that transactions in the new period can be recorded without referring back to prior adjusting entries.

Accounting for Bad Debts (Chapter 13)

- Bad Debts Expense. The operating expense account that estimates the amount of credit sales that will probably not be collectible in a given accounting period when the Allowance method is used. For the direct write-off method, this account would be the actual amount written off.

- Allowance for Doubtful Accounts. A contra-asset account that is subtracted from Accounts Receivable. This account accumulates the expected amount of uncollectibles as of a given date.

- Net realizable value. The amount (Accounts Receivable - Allowance for Doubtful Accounts) that is expected to be collected.

- Income statement approach. A method that estimates the amount of Bad Debts Expense that will result based on a percentage of net credit sales for the period. The amount of the expected bad debts is added to the existing balance of Allowance for Doubtful Accounts.

- Balance sheet approach. A method used to calculate the amount required in the Allowance for Doubtful Accounts to cover expected uncollectibles. This method is based on the Accounts Receivable amount and the aging process. The adjustment to the Allowance for Doubtful Accounts will bring the new balance of that account to the new required level.

- Aging of Accounts Receivable. The procedure of classifying accounts of individual customers by age group, where age is the number of days elapsed from due date.

- Direct write-off method. The method of writing off uncollectibles when they occur and thus does not use the Allowance for Doubtful Accounts. This method does not fulfill the matching principle of accrual accounting.

- Bad Debts Recovered. When an account receivable has been written off and is recovered, this account, which is in the Other Revenue category, is credited in the direct write-off method if the recovery is in a year following the write-off.

Notes Receivable and Notes Payable (Chapter 14)

- Interest. The cost of using money for a period of time.

- Promissory note. A formal written promise by a borrower to pay a certain sum at a fixed future date.

- Principal. The face amount of the note.

- Payee. One to whom a note is payable.

- Maturity date. Due date of the promissory note.

- Maker. One promising to pay a note.

- Note payable. A promissory note from the maker's point of view.

- Note receivable. A promissory note from the payee's point of view.

- Dishonored note. A note that was not paid at maturity by the maker.

- Default. Failure of maker to pay the maturity value of a note when due.

- Discounting a note. The process or act of transferring the note to a bank before the maturity date.

- Maturity value. The amount of the note that is due on the date of maturity (Principal + Interest).

- Discount period. The amount of time the bank holds a note that was discounted until the maturity date.

- Bank discount. What the bank charges to hold a note until maturity (Maturity Value - Proceeds).

- Proceeds. Maturity value of note less bank discount.

- Contingent liability. Liability on the part of one who discounts a note if the maker of the note defaults at maturity date.

- Discount on Notes Payable. The amount of interest deducted in advance by the lender. This account reduces notes payable.

- Effective interest rate. The true rate of simple interest.

Accounting for Merchandise Inventory (Chapter 15)

- Specific invoice method. Valuing of inventory where each item is identified with a specific invoice.

- FIFO (first-in, first-out method) Valuing of inventory assuming that the company sells the first goods received in the store.

- LIFO (last-in, first-out method). Valuing of inventory with the assumption the last goods received in the store are the first to be sold.

- Weighted-average method. Valuing of inventory where each item is assigned the same unit cost. This unit cost is found by dividing the cost of goods available for sale by the total number of units for sale.

- Consistency. The accounting principle that requires companies to follow the same accounting methods or procedures from period to period.

- Full disclosure principle. The accounting principle that requires companies to fully disclose on their financial reports changes in accounting procedures and methods along with effects of the change as well as justification for change.

- Consignment. Sales of goods through an agent who has possession but not ownership. Consignor The one who consigns merchandise to the consignee.

- Consignee. A company or person to whom merchandise is consigned but who doesn't have ownership.

- Retail method. A method used to determine the value of the ending inventory using a cost-toretail ratio. Often used for interim financial reports.

- Gross profit method. A method used to determine the value of the ending inventory using a predetermined gross profit rate. This method can be used to determine the value of ending inventory if a loss from fire occurs.

Summary of Pros and Cons of Inventory and Valuation Methods Inventory and valuation methods Pros Cons Specific invoice method - Simple to use if company has small amount of high-cost goods, such as autos, jewels, boats, or antiques.

- Flow of goods and flow of costs are the same.

- Costs are matched with the sales they helped to produce.

- Difficult to use for goods with large unit volume and small unit prices, such as nails at a hardware store or packages of toothpaste at a drug store.

- Difficult to use for decision-making purposes; ordinarily it is an impractical approach.

FIFO - The cost flow tends to follow the physical flow; most businesses try to sell the old goods first (e.g., perishables such as fruit or vegetables).

- The figure for ending inventory is made up of current costs on the balance sheet (because inventory left over is assumed to be from goods last brought into the store).

- During inflation, this method will produce higher income on the income statement and thus more taxes to be paid.

- Recent costs are not matched with recent sales, because it assumes old goods are sold first.

LIFO - Cost of goods sold is stated at or near current costs because costs of latest goods acquired are used.

- Matches current costs with current selling prices.

- During inflation, this method produces the lowest net income, which is a tax advantage. (The lower cost of ending inventory means a higher cost of goods sold; with a higher cost of goods sold, gross profit and ultimately net income are smaller and thus taxes are lower.)

- Ending inventory is valued at very old prices.

- Doesn't match physical flow of goods but can still be used to calculate the flow of costs.

Weighted-average method - Weighted-average takes into account the number of units purchased at each cost, not a simple average cost. Good for products sold in large volume, such as grains and fuels.

- Accountant assigns an equal unit cost to each unit of inventory; thus, when the income statement is prepared, net income will not fluctuate as much as with other methods.

- Current prices have no more significance than prices of goods bought months earlier.

- Compared with other methods, the most recent costs are not matched with current sales.

- Cost of ending inventory is not as up-to-date as it could be using another method.

Accounting for Property, Plant, Equipment, and Intangible Assets (Chapter 16)

- Intangible assets. Assets having no physical substance (such as patents or franchises).

- Land Improvements. An asset account that records improvements made to land; such improvements have a limited life and are subject to depreciation (examples are a driveway or fences).

- Residual value (salvage value). The amount of the asset's cost that will be recovered when the asset is sold, traded in, or scrapped.

- Straight-line method. Method that allocates an equal amount of depreciation over an asset's period of usefulness.

- Useful life. At the time an asset is acquired, an estimate is made of its usefulness in terms of years, output, and so forth.

- Units-of-production method. A depreciation method that is based on usage and not on time. An example of units of production is the numbers of shoes a machine could produce in its expected useful life.

- Double declining-balance method. An accelerated depreciation method that uses twice the straight-line rate multiplied by the book value of asset to calculate depreciation expense. Residual value is not subtracted from the cost of an asset in this calculation.

- Accelerated depreciation method. More depreciation taken in the early years of an asset's life, decreasing amounts in later years.

- Modified Accelerated Cost Recovery System (MACRS). A system for businesses to calculate depreciation for tax purposes based on the Tax Laws of 1986, 1989, and 2010; also known as the General Depreciation System (GDS).

- Capital expenditures. Original cost of an asset as well as additions or enlargements, extraordinary repairs, and betterments.

- Additions or enlargements. Major changes or improvements that increase the value of an asset (such as adding a new wing to a school).

- Extraordinary repairs. Infrequent expenditures that extend an asset's life (such as a new engine in a car).

- Betterments. Improvements that increase the efficiency of an asset by adding accessories or replacing parts with more effective and/or powerful ones.

- Revenue expenditures. Payments made for ordinary maintenance of an asset or unnecessary or unreasonable situations.

- Trade-in allowance. A value received when one asset is traded in on the purchase of another asset. For example, when you buy a new car you may trade in your old car for an amount of money that is applied toward the purchase of the new car.

- Income tax method. When plant assets are exchanged, tax law says the gain or loss must be absorbed into the cost of the new asset.

- Depletion. Amount of natural resources that has been exhausted by mining, pumping, and so forth for a period of time.

- Amortize. To charge a portion of an expenditure over a fixed number of years. Those assets with indefinite lives are not subject to amortization.

- Amortization expense. An operating expense on the income statement relating to ]]intangible asset]]s.

- Patent. An exclusive right to sell or produce one's discovery or invention. A patent is good for 20 years.

- Copyright. The exclusive right that is granted by the federal government to sell and reproduce literary, musical, or artistic works for a period of time.

- Franchise. A right granted by a business or government to produce or sell goods in a specific geographic region. Examples are Burger King and Holiday Inn.

- Goodwill. When a business is purchased, the difference between the price paid and the fair value of the net assets is goodwill. Goodwill may depend on brand names, business location, service, or other elements; it is a valuable asset that plays an important part in the expected rate of future earnings of a business.

- Impairment. Value of an intangible asset that decreases and is written off.

Partnership (Chapter 17)

- Partnership. The association of two or more persons who act as co-owners of a business.

- Uniform Partnership Act. Laws enacted in most states that govern how a partnership is formed, operated, and liquidated.

- Articles of partnership. The written contract that spells out the details of the agreement among the partners.

- Limited life. Partnership is dissolved by admission, withdrawal, or death of a partner. Although the partnership is dissolved, the operations of the business can continue if a new partnership is formed.

- Mutual agency. Act of a single partner is binding on all members of the partnership.

- Unlimited liability. Partners may be personally liable for debts of the partnership.

- General partner. A partner who has unlimited liability.

- Limited partner. The partner's liability is limited to the amount of investment in the partnership.

- Co-ownership of property. Each partner owns a share of the assets.

- Salary allowance. A mechanism for dividing earnings of a partnership based on personal services provided by the partners (not an expense).

- Interest allowance. A mechanism for dividing earnings of a partnership based on a percentage of capital balances of the partners (not an expense).

- Profit and loss ratio. An agreed-upon ratio used to divide earnings or losses of a partnership.

- Deficit. Amount by which net income falls short of salary and interest allowances. Also an abnormal, or debit, balance in a partner's capital account.

- Statement of partners' equity. A financial statement that reveals each partner's ownership percentage of the firm's capital. The ending figure for the firm's capital is then placed on the balance sheet.

- Purchase of an equity interest. Transfer of ownership between an existing partner and a new partner.

- Bonus. When a new partner is admitted, he or she may pay more or less than equity interest. If the new partner pays more, the old partners share a bonus in the profit and loss ratio. Of course, the opposite could result, and the new partner could receive a bonus if he or she invests less than equity interest.

- Liquidation. Occurs when a business is terminated, the assets are sold, and liabilities and partners are paid off.

- Realization. The conversion of noncash assets into cash in the liquidation process.

Corporations: Organizations and Stock (Chapter 18)

- Corporation. Business organization that is both a legal and accounting entity.

- Incorporator. A person responsible for getting the corporation formed.

- Articles of incorporation. Document submitted by incorporators when applying for a charter.

- Charter. Document issued to a corporation by the state that includes certificate of incorporation along with articles of incorporation.

- Certificate of incorporation. Document granted by the state authorizing the creation of a corporation.

- Stockholder. An owner of the stock of the corporation.

- Corporate director. An officer elected by stockholders to represent the company and establish policies for the company.

- Minute book. Book that records meetings of the board of directors or stockholders.

- Limited liability. Freedom of stockholders from personal liability for the debts of the corporation.

- Stock certificate. Formal document issued to investors in a corporation that shows the number of shares purchased.

- Paid-In Capital. Section of stockholders' equity representing what stockholders have invested into the corporation.

- Retained Earnings. Accumulated profits of a corporation that have been kept in the business and not paid out as dividends. Retained Earnings is part of stockholders' equity.

- Capital stock. Classes of stock that represent the fractional elements of ownership of a corporation.

- Authorized capital stock. The number of shares of capital stock (common and preferred) that a corporation can sell.

- Issued capital stock. Stock that the corporation issues for assets or services contributed by the stockholders.

- Outstanding capital stock. Stock that is held and owned by stockholders. Common stock Part of paid-in capital representing the basic ownership equity of the corporation. If the corporation has only one class of stock, it will be common stock.

- Preemptive right. The right of the stockholder to purchase additional shares of stock to maintain a proportionate interest when the corporation issues additional stock.

- Preferred stock. Class of capital stock that has preference to a corporation's profits and assets.

- Dividend. Cash, other assets, or shares of stock that a corporation issues to the stockholders.

- Cumulative preferred stock. Stock that entitles its holders to any undeclared dividends that have accumulated before common stockholders receive their dividends.

- Dividends in arrears. Dividends owed to cumulative preferred stockholders that must be paid before common stockholders can receive their dividends.

- Noncumulative preferred stock. Preferred stock that does not entitle its holders to a dividend for any year in which a dividend is not declared.

- Nonparticipating preferred stock. Preferred stock that entitles its holders only to a certain percentage of dividend, the remainder going to holders of common stock.

- Participating preferred stock. Stock that entitles its holders not only to a fixed dividend but also to an opportunity to share in additional dividends with common stockholders.

- Par value. An arbitrary value that is placed on each share of stock. Par value represents legal capital and not market value.

- Legal capital. Minimum amount of capital that a corporation must leave in the company (cannot be withdrawn by stockholders) for the protection of the creditors.

- No-par stock. Stock with no par value. A stated value could be placed on it.

- Stated value. Arbitrary value placed by the board of directors on each share of no-par stock to fulfill legal capital requirements.

- Premium. A term that records the sale of stock at more than par value. In this book we use the account Paid-In Capital in Excess of Par Value to record the premium received.

- Common Paid-In Capital in Excess of Par Value. Difference between what stockholders invest and par value. This amount is not credited to the Common Stock account.

- Discount on stock. The difference between the par value of the stock and an amount less than the par value that the stockholders have contributed. Discounts do not happen often.

- Common Paid-In Capital in Excess of Stated Value. Difference between what stockholders invest and the stated value placed on stock by the board of directors. This amount is not credited to the Common Stock account.

- Organization cost. An intangible asset that records the initial cost of forming the corporation, such as legal and incorporating fees. Today, it is being expensed.

- Stock subscription. A contractual agreement to buy a certain number of shares of stock from a corporation at a specific price.

- Common Stock Subscribed. Temporary stockholders’ equity account that records at par value stock that has been subscribed to but not fully paid for.

- Common Stock Subscriptions Receivable. Current asset on balance sheet that represents amount due on stock subscriptions.

- Source-of-capital approach. Method of preparing Paid-In Capital by listing classes of stockholder sources of capital. Legal capital approach Method of preparing Paid-In Capital by listing the legal section first.

Corporations: Stock Values, Dividends, Treasury Stocks, and Retained Earnings (Chapter 19)

- Redemption value. The price per share a corporation pays to redeem or retire capital stock.

- Market value. The price that a buyer pays to purchase shares of capital stock in the open market. Of course, for every buyer there is a seller.

- Book value per share. Amount of net assets that a stockholder would receive on a per share basis, assuming no gain or loss on the sale of the assets.

- Dividend. Cash or other assets that a corporation distributes as earnings to stockholders.

- Date of declaration. The date upon which the board of directors of a corporation formally declares a dividend.

- Dividend. Payable Liability showing amount of cash dividend owed.

- Date of record. The date of ownership that determines which stockholders will receive the dividend.

- Date of payment. The date the dividend is paid.

- Cash dividend. Dividend that is paid in cash.

- Stock dividend. Stock that is distributed to stockholders instead of cash or other assets.

- Common Stock Dividend. Distributable Stockholders' equity account that accumulates a stock dividend that has been declared but not yet issued and distributed.

- Stock split. Issuing of additional shares of stock to stockholders; total par or stated value remains the same.

- Treasury stock. Stock that has been issued but has been bought back by the corporation or received as a gift.

- Paid-In Capital from Treasury Stock. Stockholders' equity account that records amounts more or less than par value of treasury stock sold. The balance of this account can never be negative.

- Appropriated retained earnings (restricted retained earnings). That portion of Retained Earnings that is not available for dividends.

- Statement of retained earnings. A financial report that reveals the changes in retained earnings for a particular period of time.

- Prior period adjustment. Correction made in the current year of a mistake made in previous years. The adjustment is updated on the statement of retained earnings.

Corporations and Bonds Payable (Chapter 20)

- Bond. An interest-bearing note payable usually in $1,000 denominations issued by a corporation to a large group of lenders.

- Bond certificate. A piece of paper held by a bondholder showing evidence of a bond issued by a corporation to be payable on a specified date for a specific sum to the order of the person named in the bond certificate or to the bearer.

- Face value. The amount the corporation must repay to the bondholder at the maturity date.

- Contract rate. Rate of interest (based on face value) stated on bond certificate and bond indenture.

- Bond indenture. A contract that spells out the provisions of the contract between the corporation and bondholder.

- Trustee. Organization (usually a bank) or person who monitors a bond indenture for the protection of bondholders.

- Secured bond. Bond issued by a corporation that pledges specific assets as security to meet the terms of the bond agreement.

- Debenture bond. Bond that is unsecured and is issued only on the general credit of a corporation.

- Serial bond. Bond issued in a series, each one of which has a different maturity date and thus comes due at a different time.

- Registered bond. Bondholders of record are registered with the corporation, and interest checks are sent directly to them.

- Callable bond. Bond with a provision that it can be called in by the issuing corporation after a certain date.

- Convertible bond. Bondholders have the option of converting bonds into stock at a specified exchange rate.

- Effective rate. The real or actual rate of interest to the borrowing corporation.

- Carrying value (book value). Face value of bond less bond discount or plus bond premium.

- Discount on Bonds Payable. Account used when bonds are issued below face value; indicates market rate of interest is higher than contract rate. This account is a contra-liability account.

- Amortization of discount on Bonds Payable (amortization of premium on Bonds Payable). Writing off the bond premium or discount as a decrease or increase to interest expense for each interest period.

- Straight-line method. A method recognizing equal amounts of interest expense for each period when amortizing a bond discount or premium.

- Premium on Bonds Payable. Account used when bonds are issued above face value; it indicates that market interest rate is below contract rate. This account is a liability account.

- Interest method of amortization. This method amortizes the premium or discount to record interest expense, being equal to the carrying value of the bond times the market rate times the time period. The interest expense is a constant percentage of the carrying value. The discount or premium to be amortized is the difference between the interest to be recorded and the interest paid to bondholders.

- Sinking fund. A fund that accumulates cash to pay off bonds when they are retired.

- Bond Sinking Fund Interest Earned. Other revenue account used to record earnings on sinking fund balance.

Statement of Cash Flows (Chapter 21)

- Statement of cash flows. A financial report that provides a detailed breakdown of the specific increases and decreases in cash during an accounting period. It helps readers of the statement evaluate past performance as well as predict future cash flows of the business.

- Comparative balance sheet. A balance sheet listing financial condition for 2 or more years in a side-by-side manner. This format allows the reader to make quick comparisons between the two balance sheet dates.

- Operating activities. Those activities most closely related to conducting the business for which the enterprise was established. Activities such as selling merchandise and services to customers and paying salaries and other expenses needed to continue earning the operating revenue are classified as operating activities.

- Cash inflow. Any increase in cash is called a cash inflow or a source of cash. When listing the total for a major section of the statement of cash flows, if cash is increased, the figure is often described as "cash provided" by operating activities (or by investing activities or financing activities).

- Cash outflow. A decrease in cash is called a cash outflow or a use of cash. When listing a total for a major section of the statement of cash flows, if cash has decreased, the figure is often described as "cash used" in operating activities (or in investing activities or financing activities).

- Investing activities. Activities such as purchase and sale of plant and equipment and placing excess cash in stocks, bonds, and notes of other companies.

- Financing activities. Activities relating to raising money from investors and creditors such as the issuance of stocks, bonds, and long-term notes; also, repurchase of outstanding stock and retiring bonds and notes as well as paying dividends.

- Noncash investing and financing activities. Transactions such as the issuance of stock in exchange for land would be listed in a footnote or a separate schedule to the statement of cash flows, because such transactions would not be reported separately on any other financial statement.

- Indirect method. One of two methods of preparing the net cash flow from the operating activities section of the statement of cash flows. Involves converting the accrual basis net income figure from the income statement to the net cash flows from operating activities.

- Direct method. One of two methods of preparing the cash flow from operating activities section of the statement of cash flows. Each of the major areas of sources and uses of cash for operations is detailed separately.

Analyzing Financial Statements (Chapter 22)

- Comparative balance sheets. Current and past financial reports covering two or more successive periods that place data in single columns side by side.

- Horizontal analysis. Amounts of items compared on the same line of comparative financial reports. Horizontal analysis can also be in the form of a trend analysis.

- Vertical analysis. Comparing items in a financial report by expressing each item as a percentage of a certain base total.

- Common-size statements. Comparative reports in which each item is expressed as a percentage of a base amount without dollar amounts.

- Trend analysis. A type of horizontal analysis that deals with percentage changes in items on the financial reports for several years. This analysis uses a base year to calculate the percentage change of each item.

- Ratio. A relationship of two quantities or numbers, one divided by the other.

- Ratio analysis. An examination of the relationship between two numbers or sets of numbers on financial reports. Analyses of ratios, especially over time, can give a fairly clear picture of how well a company conducts its business.

- Liquidity ratios. The two ratios—current ratio and acid test ratio—which measure a company’s ability to pay off short-term debts.

- Asset management ratios. Those ratios -- accounts receivable turnover, average collection period, inventory turnover, and asset turnover -- which measure how effectively a company uses its assets.

- Debt management ratios. Those ratios -- debt to total assets, debt to stockholders' equity, and times interest earned ratio -- which measure a company's mix of debt and equity financing.

- Profitability ratios. Those ratios -- gross profit rate, return on sales, return on total assets, and return on common stockholders' equity -- which measure a company's ability to earn a profit.

- Current ratio. A liquidity ratio; current assets are divided by current liabilities to indicate a company's ability to pay its short-term debt. This ratio does not provide as much certainty as the acid test ratio.

- Acid test ratio. A liquidity ratio; those assets that are most easily converted to cash are divided by current liabilities to indicate ability to pay off short-term debt. Also called quick ratio.

- Quick assets. Those assets -- mainly cash, accounts receivable, and notes receivable -- that can be easily turned into cash.

- Accounts receivable turnover ratio. A ratio that indicates the number of times accounts receivable are converted to cash within a given period and the effectiveness of a company's credit policy.

- Average collection period. A ratio that shows how quickly moneys owed are received from customers and thereby measures how effectively a company collects its accounts receivable.

- Inventory turnover ratio. An asset management ratio that indicates how quickly inventory moves off the shelf and therefore how well a company sells its product.

- Asset turnover ratio. A ratio that indicates how efficiently a company uses its assets to generate sales and thus helps measure the overall efficiency of the company.

- Debt to total assets ratio. A ratio that shows how much of a company's assets are financed by creditors.

- Debt to stockholders' equity ratio. A ratio in which total liabilities are divided by the amount of stock that is owned to measure the risk creditors run in comparison with stockholders.

- Times interest earned ratio. A debt management ratio indicating the degree of risk to lenders that a company will default on its interest payments. Also called interest coverage ratio.

- Gross profit rate. A profitability ratio that indicates how well net sales cover administrative and selling expenses.

- Return on sales ratio. A profitability ratio that shows the relationship of net income before taxes to net sales and thereby the effectiveness of a company's pricing policy.

- Return on total assets ratio. A profitability ratio that measures how wisely a company has invested in and managed its assets. This ratio can be arrived at in two ways: (1) net income before interest and taxes divided by total assets and (2) return on sales multiplied by asset turnover.

- Return on common stockholders' equity ratio. A profitability ratio that indicates how well a company is managing debt financing to earn a profit for holders of common stock.

Ratio Formula What calculation says Key points Current ratio Current Assets / Current Liabilities For each $1 of current liabilities, how many dollars of current assets are available to meet the current debt. The ratio should be evaluated based on the type of business credit terms, along with the composition of the current assets. Acid test ratio (Current Assets - Merchandise Inventory - Prepaid Expenses) / Current Liabilities For each $1 of current liabilities, how many dollars of cash and nearcash assets are available to meet the current debt. Because inventory and prepaid expenses may not be easily converted into cash, they are not used in the calculation. Accounts receivable turnover Net Credit Sales / Average Accounts Receivable How many times accounts receivable are collected and turned into cash. Cash sales are not included in the calculation. High turnover is often the best unless the credit terms cause a reduction in sales. Average collection period 365 Days / Accounts Receivable Turnover The number of days that it takes a business to collect its accounts receivable. If the average collection period goes up and the credit terms remain the same, increased collection attempts should be emphasized. Inventory turnover Cost of Goods Sold / Average Inventory The number of times a company sells or turns over its average amount of inventory per year. High turnover rates indicate that the company sold its average amount of inventory several times per year. Care should be taken to avoid running out of inventory and losing sales due to insufficient inventory on hand. Asset turnover Net Sales / Total Assets How effectively the company is using its assets to generate sales, i.e. how much in sales the co. generates per $1 dollar invested in assets. A low turnover could mean excessive investment in assets or that the sales volume is too low. Debt to total assets Total Liabilities / Total Assets Amount of assets financed by the creditors. A low percentage reduces creditors' risk if liquidation occurs. The higher the percentage, the more debt financing a company is using. Debt to stockholders' equity Total Liabilities / Stockholders' Equity Amount of debt in relation to total stockholders' equity. The higher the percentage, the more interest cost results for stockholders. Times interest earned Income Before Taxes and Interest Expense / Interest Expense Degree of risk to creditors if a company defaults on interest payments by indicating how many times a corporation could cover their interest obligations with their income before interest and taxes. A high times interest earned means a company can have declines in earnings but have the ability to meet its annual interest obligations. Gross profit rate Gross Profit / Net Sales Profit generated from each sales dollar that will be used to cover expenses (general, selling, etc.). This rate could drop if stiff competition results in price cuts. Return on sales Net Income Before Taxes / Net Sales How much net income a company earns on each sales dollar. A company with a low inventory turnover rate usually prices goods for a high return on sales. Rate of return on total assets Net Income Before Interest and Taxes / Total Assets Without looking at how assets are financed, this ratio measures how productively total assets have been used, i.e. how much net income is generated by each dollar invested in assets. The rate of return can be increased by controlling costs and expenses as well as increasing asset turnover. Rate of return on common stockholders' equity (Net Income Before Taxes - Preferred Dividends) / Common Stockholders' Equity Measures a company's ability to earn profits for the common stockholder by indicating how much net income is generated by each dollar of common SE. If this rate is higher than return on total assets, the company is using financial leverage to its benefit.

The Voucher System (Chapter 23)

- Voucher. A written authorization form containing data about a transaction along with proper authorizations for payment, account distributions, and so forth.

- Voucher system. An internal control system designed to control a company's cash payments.

- Voucher register. A special journal replacing the purchases journal; it records prenumbered vouchers at the time the liabilities are incurred.

- Vouchers Payable. A liability account in the general ledger that represents the controlling account for the sum of individual vouchers.

- Unpaid voucher file (tickler file). The file containing unpaid vouchers arranged by due dates to take advantage of cash discounts.

- Check register. A special journal that replaces the cash payments journal in recording payments of vouchers.

- Paid voucher file. Holds paid vouchers filed either in sequential order by voucher number or alphabetically by creditor's name.

Departmental Accounting (Chapter 24)

- Profit center. A unit or department that incurs costs and generates revenues.

- Cost center. A unit or department that incurs costs but does not generate revenues.

- Direct expenses. Expenses that can be traced directly to a specific department.

- Indirect expenses. Expenses that cannot be traced directly to one department.

- Contribution margin. A department's net profit, used to cover indirect expenses.

Manufacturing Accounting (Chapter 25)

- Raw material. Material that is to be processed into a finished product or that changes the quality or characteristics of the product.

- Direct labor. The wages of those persons whose efforts directly affect the quality or other characteristics of the products manufactured.

- Manufacturing overhead. All the manufacturing costs except raw material and direct labor.

- Receiving report. A document prepared by the receiving department to evidence the receipt of material or supplies that had been ordered.

- Material requisition. A document used to order material or supplies from the storeroom that provides the basis for charging material into production.

- Clock card. A card used by employees when clocking in and out of the factory; it becomes the basis for the payroll.

- Lot ticket. A document prepared to show the movement of materials or products between departments. Also called move ticket.

- Labor distribution report. A report issued by the payroll department to categorize all the types of labor incurred during the week.

- Bill of lading. A formal document issued to the carrier of the finished product. It is the basis for charging the cost of goods sold.