Bookkeeping cycle

(Redirected from Accounting cycle)

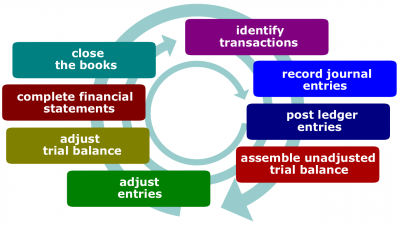

Bookkeeping cycle (alternatively known as accounting cycle; hereinafter, the Cycle) is the process that begins with the recording of financial transactions or procedures into books of original entry and ends with the completion of a post-closing trial balance for each accounting period.

Trivia

Definitions

According to College Accounting: A Practical Approach by Slater (13th edition),

- Accounting cycle. For each accounting period, the process that begins with the recording of business transactions or procedures into a general journal and ends with the completion of a post-closing trial balance.

Description

- The Cycle is usually based from the 1st day of the month to the last day of the month, and repeats every month. Bank reconciliations are done to the end of the month, financial reports produced for the month, sales tax and payroll tax calculated at least for the month. The month end is 'closed off' and financial transactions for that month should not be changed in any way except by reversing or correcting journals and only carried out in the next month. This goes on for 12 months until the end of the financial year when all the data is often sent to a Certified Public Accountant.

Stages

- End of month. The bookkeeping cycle is usually based on one month, every month. At the end of the month, there are various steps a bookkeeper needs to take to close off the month, such as (1) Reconciling the bank account to the last day of the month, (2) making sure all sales have been issued on invoice to customers, (3) checking that all supplier invoices dated to the last day of the month are entered into the system, (4) performing various checks on the various bookkeeping accounts to ensure information has been coded to the right place and all is balancing, (5) making sure the various sales tax and paye tax has been calculated and reported and paid to the government. Depending on the size of the business, it can take a bookkeeper several weeks into the following month to get the previous month finalized and closed off, after which no changes should be made other than with journals in the current month.

- Year-end. The financial year-end is always busy for a bookkeeper because this is when the accounts for the year need to be finalized and handed over to an accountant to calculate how much tax a business needs to pay to the government. What the bookkeeper needs to do is ensure all bank reconciliations completed, all transaction entries are coded correctly, all supporting paperwork is available and all sales taxes and paye taxes have been processed.

- Data import. Data brought into the bookkeeping records through a digital import. This could include bank transactions which can be downloaded from the bank in a special format such as CSV, or it could be contact names and addresses from another program such as excel. Import can also mean to bring into the country stock purchased overseas.

- Reconcile. The process of matching one set of figures or documents with another set of figures or documents. For example, matching the cash book with the bank account and investigating and fixing any differences; or checking that the business has received all the invoices listed on a supplier's statement and if any are missing phoning the supplier for them.

- Write-off. An amount that will not be paid by a customer can be written off. This just means that an entry is made to the accounts to bring the customer's account down to zero.

Related concepts

- Bookkeeping. Recording, filing, and retrieving of financial data, as well as producing those financial reports that are required by laws.