Bookkeeping Quarter

Bookkeeping Quarter (hereinafter, the Quarter) is a lecture introducing the learners to organizational discovery primarily through key topics related to bookkeeping. The Quarter is the first of four lectures of Organizational Quadrivium, which is the last of seven modules of Septem Artes Administrativi (hereinafter, the Course). The Course is designed to introduce the learners to general concepts in business administration, management, and organizational behavior.

Contents

Outline

Leadership Quarter is the predecessor lecture. In the enterprise discovery series, the previous lecture is Market Intercourses Quarter.

- Organizational discovery is data discovery conducted by organizations. For financial purposes, organizations, as legal entities, collect their data through bookkeeping. This particular lecture concentrates on that topic.

Concepts

- Bookkeeping. Recording, filing, and retrieving of financial data, as well as producing those financial reports that are required by laws. Bookkeeping can also be defined as the recording, filling, and retrieving functions of accounting.

- Accounting. A system that measures the business' activities in financial terms, provides written reports and financial statements about those activities, and communicates these reports to decision makers and other relevant stakeholders including the government. Accounting can also be defined as the process of sorting and entering financial data into a bookkeeping system, as well as the finalizing of end of year accounts, producing financial statements and calculating tax payable often by a Certified Public Accountant.

- Bookkeeping system (financial books, organization's books, etc.) is a system of financial books that a legal entity organizes in order to record, file, and retrieve financial data, as well as to produce those financial reports that are required by laws.

- Financial account (or, simply, account). The place where financial entries of a similar nature are recorded, for example the 'Sales' account is where business income goes, the 'Stationery' account is where all pens, paper, staplers etc go. A list of account names is called the chart of accounts.

- Normal balance of an account. The side of an account that increases by the rules of debit and credit.

- Rules of debit and credit.

- Financial transaction. Any transfer of items, properties, and resources of value that an organization owns, is about to own, or is about to stop owning.

- Transaction reference. A number or combination of numbers or letters that are used to identify each transaction within the journals following through to the ledgers. Each financial transaction is allocated a unique reference that can be traced easily through the bookkeeping system.

- Recurring. A transaction that repeats regularly every week or month for the same amount to the same place is said to be a repeating or recurring transaction.

- Journal entry. Any record of any financial transactions carried out by a legal entity that is made utilizing the double-entry bookkeeping system and describes which financial account or accounts are being debited and which are credited, the date, the reason for the journal entry, and a reference.

- Compound journal entry. A transaction involving more than one debit and/or credit.

- Assets. Items, properties, and resources of value owned by an organization. Assets are found on the balance sheet and include cash in the bank accounts, cash in petty cash box, accounts receivable, equipment, land and buildings, vehicles, etc.

- Account receivable (A/R or receivable). An asset that indicates the amount owed to an legal entity. Usually, but not necessarily, customers owe those amounts and those amounts represent their outstanding balances such as unpaid sales invoices that customers owe to the legal entity. Anything that is receivable means that a legal entity expects to receive money at some point of time. Every account receivable is listed on special financial account such as Accounts Receivable or similar accounts. They are a part of the Assets. Further, once the customer pays their invoice, the former account receivable is removed (or credited) from Accounts Receivable to other accounts such as Cash at Bank.

- Petty cash. A business can keep cash in a safe place for the purpose of making small purchases like milk, stamps, pens etc. The petty cash is monitored carefully by the bookkeeper. All money paid out must be recorded in the petty cash book so that the expenses can be included in the accounts, and when the cash runs low it will be topped up with an injection of more cash.

- Supplies. The type of assets acquired by an organization that has a much shorter life than equipment.

- Expenses. A cost incurred in running a business by consuming goods or services in producing revenue. Expenses is a subdivision of owner's equity. Expenses are found on an income statement and particularly can be used to reduce the amount of tax owed to the government.

- Cost of goods sold. Also known as cost of sales. This is the cost to the business of any parts or stock that are sold to customers. This can also include the manufacturing costs of such products.

- Payroll. Anyone in employment who is paid a wage or salary will have their name on the payroll of the business. The bookkeeper in charge of payroll will ensure that all the relevant details of each employee is entered into the payroll program, will process a pay run on a regular basis to calculate how much each employee will be paid, and will make sure the payments happen on time. The bookkeeper or payroll clerk will also ensure that paye is paid to the government.

- Salary. A salary is a fixed amount paid to an employee for their work. People on salaries do not earn overtime pay like a wage earner when working more than their standard hours.

- Wages. A payment made to an employee for the work they do. Wages are usually based on an hourly rate agreed between the employer and employee. Income tax is also usually deducted from the total so the employee receives a net payment. Wages are found on the profit and loss under expenses.

- PAYE. Short for pay as you earn, which means that individuals who earn wages or salaries have tax deducted from each pay by their employer. The employer is responsible for passing this deduction on to the government, usually on a monthly basis.

- Depreciation. The allocation (spreading) of the cost of an asset such as an auto or equipment over its expected useful life. Depreciation represents decrease in worth of most assets belonging to a legal entity over time due to wear and tear and daily use. Short-life assets can immediately be moved to Expenses. On the contrary, land can never be depreciated. The value that is used to depreciate the assets is calculated particularly with special rates set by the tax department. It is usually a percentage of the cost price, less previously calculated depreciation. Depreciation can be claimed as a business expense to reduce income tax.

- Historical cost. The actual cost of an asset at time of purchase.

- Residual value. Estimated value of an asset after all the allowable depreciation has been taken.

- Book value. Cost of equipment less accumulated depreciation.

- Accumulated Depreciation. A contra-asset account that summarizes or accumulates the amount of depreciation that has been taken on an asset.

- Asset claims (equities). The rights of financial claims of creditors (liabilities) and owners (owner's equity) who supply the assets to an organization. Asset claims (equities) = liabilities (debtors' equity) + owner's equity. The monetary amount of asset claims are always equal to that amount of assets; assets = asset claims.

- Basic accounting equation. Assets = Liabilities + Owner's equity; the same equation can be expressed as Owner's equity = Assets less Liabilities, etc. The double-entry method of bookkeeping is based on this equation.

- Liabilities (debtors' equity). Obligations of a legal entity to its creditors. In other words, liabilities are the financial rights or claims of creditors to some assets that a legal entity currently owns. Liabilities come due in the future. They are made up of debts that the company owes to other legal entities. Liabilities may include accounts payable, loans and credit card balances; liabilities can be found on the balance sheet.

- Account payable (A/P or payable). Any unpaid balances such as unpaid supplier invoices and bills that the legal entity owes to its vendors. In other words, any account payable represent some amounts owed by a legal entity to its creditors that result particularly from the purchase of goods or services on account. Any bill that is due to be paid now or will be due in some future is called a payable. Special financial accounts such as Accounts Payable include the complete list of accounts payable. Once a bill is paid it is removed (or debited) from Accounts Payable. Accounts Payable are a part of the Liabilities.

- Loan. A business can buy asset with a loan from a bank or finance company. Loans are recorded as a liability in the balance sheet

- Owner's equity. Ownership expressed in a difference between how much the business owners have contributed to the business from personal funds (Owner's Capital) and how much these owners have withdrawn from the business for personal use (Owner's Withdrawals). In other words, owner's equity is rights of financial claims to the assets of an organization. In the basic accounting equation, assets minus liabilities). In bookkeeping (and, consequently, accounting), this difference is found on the balance sheet: Owner's equity = Assets minus Liabilities. In finance, owner's equity can be defined as ownership in any asset after all debts associated with that asset are paid off. In terms of startup, it is commonly used to describe a business giving up a percentage of ownership in exchange for cash. An equity investor is then entitled to share in any future profits and/or sale of business assets (after debts are paid off).

- Owner's Capital. (1) The owner's investment of equity in the organization that he, she, or it owns. For startup businesses, for instance, Owner's Capital can be the personal funds a business owner introduces to his, her, or its business so that it can operate; (2) Monetary assets currently available for use. Entrepreneurs raise capital to start a company and continue raising capital to grow the company.

- Owner's Withdrawals. A subdivision of owner's equity that records money or other assets an owner withdraws from his, her, or its organization for personal use.

- Revenue. An amount earned by performing services for customers or selling goods to customers; it can be in the form of cash or accounts receivable. Revenue is a subdivision of owner's equity: As revenue increases, owner's equity increases.

- Sales. All items or services sold to customers fall within the sales category.

- Billing. Invoicing customers for goods or services they have purchased from the business.

- Timebilling. Timebilling is the process of taking data from an employee’s timesheet and charging it onto customers. The data is made up of the hours that the employee spent working on something for the customer, a description of the job and any other costs associated with the job.

- Margin. Margins are calculated as percentages. One example is the gross profit margin which is based on sales divided by gross profit and the result turned into a percentage. Businesses can chose what margins they should have to be able to earn a profit and based on those margins decide what prices to sell their products to make this happen.

- Income Summary. A temporary account in the ledger that summarizes revenue and expenses and transfers the balance (either net income or net loss) to Owner's Capital. This account does not have a normal balance (i.e., it could have a debit or a credit balance.

- Gross profit. This is calculated by taking the business income and deducting the cost of sales. If the cost of sales is more than the income a Gross Loss results.

- Net income. The financial result of operations when revenue totals more than expenses.

- Net loss. The financial result of operations when expenses total more than revenue.

- Funds. The money or value of money involved in all financial transactions within the business or at the bank.

- Purchase. When a business buys goods or services it is called purchasing.

- Hire purchase. Buying equipment such as a computer by paying it off through a finance company. At the end of the lease period the business will have the option of making a final payment to own it, or they can return the equipment and upgrade to a newer model. The new model can be paid off through the finance company, so the whole process starts again.

- Quote. When a business needs services or parts they can shop around and ask for suppliers to provide a written cost for the parts or services – this is a quote. The business would chose the supplier who provided the best quote. Quotes are usually only valid for a certain time frame – a few weeks or months.

- Deductible. A purchase that can be claimed as a business expense is called a deductible expense because it has the effect of reducing the business profit, therefore reducing the amount of income tax owed to the government. A non deductible purchase is one that cannot be used to reduce the profit and tax such as when the owner uses business funds to buy something for personal use

- Inventory. A list of items that a business buys and sells. These items are kept in a store room of some sorts and a strict record kept of the number of items on hand at any given time.

- Refund. A refund can be provided to or from another business if bills have been overpaid.

- Reimburse. An individual who buys something for the business with personal funds can be reimbursed by the business i.e. paid back for that purchase.

- Tax. A deduction from the income earned by a business or individual. The deduction is paid to the government. The government uses taxes to maintain and run the country.

- Transfer. The allocation of funds from one account to another.

- Cashflow. The movement of cash through the business; this report details how cash flowed into the business and what it was spent on. Estimations can also be made in a cashflow forecast on the income and expenses for the year ahead - these figures will be based on prior earnings and costs and can help a business work out their sales goals and budget.

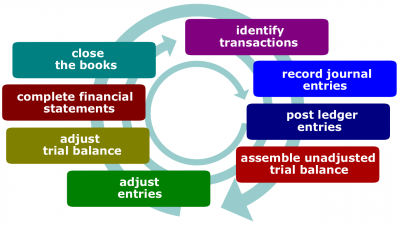

- Bookkeeping cycle (accounting cycle). The process that begins with the recording of financial transactions or procedures into books of original entry and ends with the completion of a post-closing trial balance for each accounting period. A bookkeeping cycle is usually based from the 1st day of the month to the last day of the month, and repeats every month. Bank reconciliations are done to the end of the month, financial reports produced for the month, sales tax and payroll tax calculated at least for the month. The month end is 'closed off' and financial transactions for that month should not be changed in any way except by reversing or correcting journals and only carried out in the next month. This goes on for 12 months until the end of the financial year when all the data is often sent to a Certified Public Accountant.

- Accounting period. The period of time for which an income statement is prepared.

- End of month. The bookkeeping cycle is usually based on one month, every month. At the end of the month, there are various steps a bookkeeper needs to take to close off the month, such as (1) Reconciling the bank account to the last day of the month, (2) making sure all sales have been issued on invoice to customers, (3) checking that all supplier invoices dated to the last day of the month are entered into the system, (4) performing various checks on the various bookkeeping accounts to ensure information has been coded to the right place and all is balancing, (5) making sure the various sales tax and paye tax has been calculated and reported and paid to the government. Depending on the size of the business, it can take a bookkeeper several weeks into the following month to get the previous month finalized and closed off, after which no changes should be made other than with journals in the current month.

- Year-end. The financial year-end is always busy for a bookkeeper because this is when the accounts for the year need to be finalized and handed over to an accountant to calculate how much tax a business needs to pay to the government. What the bookkeeper needs to do is ensure all bank reconciliations completed, all transaction entries are coded correctly, all supporting paperwork is available and all sales taxes and paye taxes have been processed.

- Trial balance. A list of the ending balances of all the accounts in a ledger. The total of the debits should equal the total of the credits. Alternatively, trial balance can be defined as an informal listing of the ledger accounts and their balances in the ledger to aid in providing the equality of debits and credits.

- Reconcile. The process of matching one set of figures or documents with another set of figures or documents. For example, matching the cash book with the bank account and investigating and fixing any differences; or checking that the business has received all the invoices listed on a supplier’s statement and if any are missing phoning the supplier for them.

- Write-off. An amount that will not be paid by a customer can be written off. This just means that an entry is made to the accounts to bring the customer's account down to zero.

Roles

- Bookkeeper. A trained and qualified person who does bookkeeping.

- Creditor. Anyone who has a claim to assets of a legal entity, but not an owner of this entity. For instance, a creditor can be the person or business to whom another business owes money for purchases made.

- Debtor. A customer that owes your business money.

Institutions

- Bank. The secure financial institution where businesses deposit their earnings and from which they pays their bills. Banks provide business advice and can advances loans to businesses for growth.

- Bank statement. A report which the bank produces listing in date order all the money received and all the money paid out of the bank account, ending with the balance of cash in the account.

- Withdrawal. When funds are taken out of a bank account they are ‘withdrawn’.

- Deposit. When money (cash or checks) is paid into a bank account it is called a deposit.

Methods

- Double-entry bookkeeping. The method of bookkeeping in which all financial transactions are entered twice –- as a debit in one account and as a credit to another. All the debits need to equal the same as the credits. If they don't it is called being out of balance and the error will need to be found.

- Debit (debit entry or Dr). Any entry into the bookkeeping system that either increases asset-origin accounts or decreases equity-origin accounts. Any journal entry contains at least one debit. In a T-account, a debit balance is found on the left-hand side. A number entered on the left side of any T-account is said to be debited to this account.

- Credit (credit entry or Cr). Any entry into the bookkeeping system that either increases equity-origin accounts or decreases asset-origin accounts. Any journal entry contains at least one credit. In a T-account, a debit balance is found on the right-hand side. In addition, credit could also refer to (a) an account receivable when an organization allows a customer to delay the payment or (b) an account payable when an organization owes funds to a supplier or, often a bank, referring to a credit made by another organization. Credit could also refer to money that is owed on a credit card. When you want to open an account with a supplier you may be asked to fill in what is called a credit application. A number entered on the right side of any T-account is said to be credited to this account.

- Filing. Filing is the process of putting away documents in a systematic method. Also, when a bookkeeper says “I am filing the sales tax” they mean they are sending a report to the government on how much sales tax the business has to pay for the month, or “I am filing the paye” they mean they are sending a report to the government showing how much payroll tax is due for payment by the business.

- Cash basis. An accounting system that records revenue when cash is received and expenses when paid. This system does not match revenues and expenses like in the accrual basis of accounting.

- Accrual basis. An accounting system that matches revenues when earned with expenses that are incurred.

Instruments

- Financial book.

- Chart of accounts. Any numbering system that an organization uses in order to categorize all the financial transactions while assigning them to different financial accounts. A chart of accounts lists the account titles and account numbers to be used by an organization. The main categories are Assets, Liabilities, Owner's equity, Fiscal Revenue, Expenses including cost of goods sold, as well as temporary accounts such as Income Summary.

- Book of original entry. Book that records the first formal information about financial transactions. A general journal is an example of a book of original entry.

- General journal. A chronological log of journal entries recorded utilizing double-entry bookkeeping. In other words, a general journal is a listing of financial transactions in chronological order. General journal is a book of original entry.

- Cash book. The main book in which is recorded all the funds moving in and out of the business through the bank account. The cash book always contains the following information for all of these transactions: date, amount, description of transaction, bookkeeping account as per chart of accounts and reference.

- Book of final entry. Book that records information about financial transactions from a book of original entry such as a general journal. A ledger is an example of a book of final entry.

- Ledger. The book of final entry that represents all financial accounts of a legal entity. The ledger's data is originated from book of original entry and taken either directly or through financial reports such as income statement. On the contrary to any book of original entry that groups data in chronologically-recorded financial transactions, the ledger groups data in separate financial accounts. Each financial account on the chart of accounts has its separate section, usually one or more pages, in the ledger. This section lists all the debits or credits made against the financial account. Every ledger section is totaled periodically, but at least once, at the end of every fiscal year.

- T-account. A skeleton version of a financial account that is used in a ledger and/or for demonstration purposes.

- Footings. The totals of each side of a T-account.

- Ending balance. The difference between footings in a T-account.

- Financial reporting standard.

- Generally Accepted Accounting Principles (GAAP). The procedures and guidelines that must be followed during the accounting process.

- International Financial Reporting Standards. A group of accounting standards and procedures that if adopted by the United States could replace GAAP.

- Accounting software. Computer programs that are used to keep the financial data (like Odoo) or for processing payroll, or for typing up documents and reports (excel and word).

Results

- Financial report. Reports that are produced by a tax accountant at the end of the financial year based on all the data entered to the bookkeeping system by the bookkeeper. These reports indicate how well the business is or is not doing, what the business is worth, and are used to calculate income tax due to be paid to the government.

- Balance sheet (also known as statement of financial position). A financial report, as of a particular date, that shows the amount of assets owned by an organization as well as the amount of claims (liabilities and owner's equity) against these assets. A balance sheet shows the owners, managers, and authorized stakeholders how much owner's equity is in the business, how many assets the business owns, and what the business owes in liabilities. The balance sheet falls in line with the basic accounting equation.

- Statement of owner's equity. A financial statement that reveals the change in capital. The ending figure for capital is then placed on the balance sheet.

- Income statement (or profit and loss report). An accounting statement that details the performance of an organization (revenue minus expenses) for a specific period of time.

- Financial document.

- Check (outside of the United States known as cheque). Special pre-printed slips of paper in book format produced by the bank. These are used by a business to pay their bills in place of cash or instead of internet banking. These notes are completed by the business by entering the date, the name of the person/business being paid and the amount in numeric value and word value. They have to be signed by the authorized signatory of the bank account and usually expire 3 to 6 months after the date issued. It is safe to send checks in the post, unlike cash which can be stolen.

- Receipt. When payments are received from customers a receipt can be issued to them to confirm the details of the payment received, particularly useful for cash payments – the receipt provides proof of payment. Also, receipts are what everyone gets when shopping with their bank card and swiping the card through the electronic machine at the shop counter. Businesses should keep these receipts in a folder to match them up to the bank statement ensuring an accurate cash book.

- Invoice. A document that details the sale or purchase of stock, parts or services. The invoice will show the main details such as date, invoice number, quantity, description, cost, total, payment terms. When a business buys the products or services it will receive a purchase invoice and when the business sells products or services it will provide a sales invoice to the customer.

- Remittance. A document that is given to a supplier or received from a customer that lists what invoices are included in a payment made.

- Financial data. The financial information found inside the bookkeeping system.

Practices

Enterprise Intelligence Quarter is the successor lecture. In the enterprise research series, the next lecture is Feasibility Study Quarter.