Difference between revisions of "Feasibility Study Quarter"

(→Methods) |

|||

| (97 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

| − | [[Feasibility Study Quarter]] (hereinafter, the ''Quarter'') is the | + | [[Feasibility Study Quarter]] (hereinafter, the ''Quarter'') is a lecture introducing the learners to [[portfolio research]] primarily through key topics related to [[feasibility study]]. The ''Quarter'' is the second of four lectures of [[Portfolio Quadrivium]], which is the first of seven modules of '''[[Septem Artes Administrativi]]''' (hereinafter, the ''Course''). The ''Course'' is designed to introduce the learners to general concepts in [[business administration]], [[management]], and [[organizational behavior]]. |

| − | |||

| − | |||

| − | |||

| − | |||

==Outline== | ==Outline== | ||

| − | '' | + | ''[[Idea Generation Quarter]] is the predecessor lecture. In the [[enterprise discovery]] series, the previous lecture is [[Bookkeeping Quarter]].'' |

| − | + | :[[Portfolio research]] is the [[enterprise research]] of [[data]] needed to design and/or modify the [[enterprise portfolio]]. Organizationally, the [[data]] needed to design or modify these [[market exchangeable]]s is collected through [[idea generation]], [[validated learning]], [[monitoring]], and [[market intercourse]]s. This particular lecture concentrates on [[validated learning]] because these [[enterprise effort]]s are the primary method for collecting [[data]] that emerges as a result of [[product development]]s. This lecture concentrates on [[feasibility study]] of [[proposed change]]s because the [[data]] collected from [[operational business]]es is researched through [[controlling]]. | |

| − | |||

| − | :[[ | ||

| − | |||

| − | |||

| − | |||

| − | |||

===Concepts=== | ===Concepts=== | ||

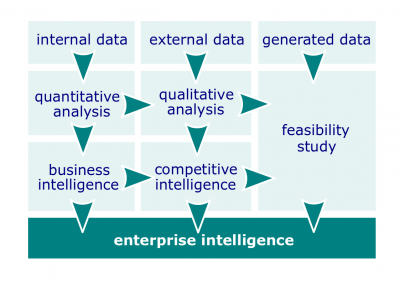

| − | #'''[[Feasibility study]]'''. In [[enterprise administration]], an assessment of the practical potential of a [[proposed change]]. Depending on the nature of the [[proposed change]] and the complexity of its [[proposed change implementation|implementation]], this assessment may consist of one or more evaluations | + | #[[File:Enterprise-intelligence.png|400px|thumb|right|[[Enterprise intelligence]]]]'''[[Feasibility study]]'''. In [[enterprise administration]], an assessment of the practical potential of a [[proposed change]]. Depending on the nature of the [[proposed change]] and the complexity of its [[proposed change implementation|implementation]], this assessment may consist of one or more evaluations; a [[feasibility study]] may also not be feasible itself. [[Feasibility study]] can also be described as an evaluation of proposed alternatives to determine if they are legally and technically possible within the constraints of the enterprise and whether they will deliver the desired benefits to the enterprise. |

| − | + | #*[[Proposed change]]. Any [[change]] that is proposed in order to be implemented. | |

| − | #*[[ | + | #*[[Proposed change implementation]]. A [[project]] undertaken in order to implement the [[proposed change]]. |

| − | #*[[ | + | #'''[[Change]]'''. In [[enterprise administration]], the act or instance of becoming different and/or doing business differently. |

| − | # | ||

#*[[Unexpected change]]. Change activities that are unintentional and not necessarily goal oriented. | #*[[Unexpected change]]. Change activities that are unintentional and not necessarily goal oriented. | ||

#*[[Planned change]]. Change activities that are intentional and goal oriented. | #*[[Planned change]]. Change activities that are intentional and goal oriented. | ||

| − | |||

| − | |||

#'''[[Idea evaluation]]'''. An appraisal of potential solutions to problems to identify the best one. | #'''[[Idea evaluation]]'''. An appraisal of potential solutions to problems to identify the best one. | ||

#*[[Evaluation]]. The systematic and objective assessment of a solution to determine its status and efficacy in meeting objectives over time, and to identify ways to improve the solution to better meet objectives. See also metric, indicator and monitoring. | #*[[Evaluation]]. The systematic and objective assessment of a solution to determine its status and efficacy in meeting objectives over time, and to identify ways to improve the solution to better meet objectives. See also metric, indicator and monitoring. | ||

#*[[Domain]]. The problem area undergoing analysis. | #*[[Domain]]. The problem area undergoing analysis. | ||

#*[[Opportunity analysis]]. The process of examining new business opportunities to improve organizational performance. | #*[[Opportunity analysis]]. The process of examining new business opportunities to improve organizational performance. | ||

| + | #*[[Social screening]]. Approving social criteria (screens) to investment decisions. | ||

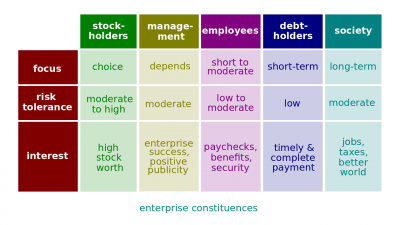

| + | #[[File:Enterprise-constituencies.png|400px|thumb|right|[[Enterprise constituency]]]]'''[[Enterprise environment]]'''. (1) The surroundings or conditions in which an [[enterprise]] operates; (2) The combined [[internal environment|internal]] and [[external environment|external]] factors and forces, both standing alone and interacting with one another, that affect or can potentially affect the enterprise's performance. | ||

| + | #*[[Structured environment]] (or [[controlled environment]]). A certain, predictable environment under one's control. | ||

| + | #*[[Unstructured environment]]. An uncertain, unpredictable environment with unknown or no structure. | ||

| + | #*[[Internal environment]]. (1) Those [[factor]]s and forces inside of somebody or something that affect or can potentially affect his, her, or its performance; (2) [[Enterprise environment]] within the borders of the [[enterprise]]. | ||

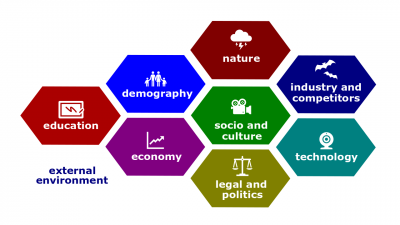

| + | #*[[File:External-environment.png|400px|thumb|right|[[External environment]]]][[External environment]]. (1) Those [[factor]]s and forces outside of somebody or something that affect or can potentially affect his, her, or its performance; (2) [[Enterprise environment]] beyond the borders of the [[enterprise]]. | ||

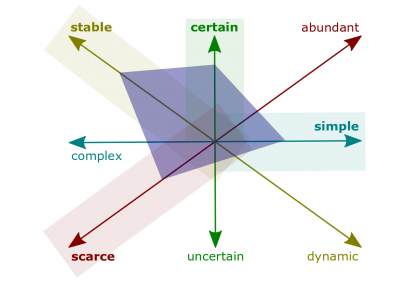

| + | #[[File:Environment-characteristics.png|400px|thumb|right|[[Environment characteristic]]s]]'''[[Environment characteristic]]'''. Any distinguishing trait, quality, or property of the environment. | ||

#*[[Enterprise environmental complexity]]. The number of components in an enterprise's environment and the extent of the enterprise's knowledge about its components. | #*[[Enterprise environmental complexity]]. The number of components in an enterprise's environment and the extent of the enterprise's knowledge about its components. | ||

#*[[Enterprise environmental uncertainty]]. The degree of change and complexity in an enterprise's environment. | #*[[Enterprise environmental uncertainty]]. The degree of change and complexity in an enterprise's environment. | ||

| − | #*[[ | + | #'''[[Change readiness assessment]]'''. An assessment that describes whether stakeholders are prepared to accept the change associated with a solution and are able to use it effectively. |

| − | #*[[ | + | #*[[Business capability]]. A function of an organization that enables it to achieve a business goal or objective. |

| − | #* | + | #*[[Compliance feasibility]]. An assessment of how the [[proposed change]] would conflict with legal, corporate, and other mandated requirements. |

| − | + | #*[[Integration feasibility]]. An assessment of how the [[proposed change]] would conflict with existing systems that the enterprise already employs. | |

| − | #'''[[Cost-benefit analysis]]'''. | + | #'''[[Cost-benefit analysis]]'''. An [[analysis]] of the difference between the [[change benefit estimate]], which is what the enterprise is going to obtain, and [[change cost estimate]], which is what the enterprise is going to lose when some [[proposed change]] is implemented. In other words, the financial and non-financial costs of making a [[change]] or implementing a [[solution]] are compared and quantified to the benefits gained during this ''analysis''. Usually, the [[cost-benefit analysis]] is the core of [[feasibility study]]. |

| − | # | + | #*[[Change benefit estimate]]. The difference between the positive and negative impacts of the [[proposed change]]. The positive impact can be assessed as the expected total value that the [[enterprise]] is going to obtain after a [[proposed change]] is implemented. The negative impact is what the enterprise is going to lose. These estimates may have several components and may be obtained as a result of an [[impact analysis]]. |

| − | #*[[Change cost estimate]]. The expected total cost of a set of [[enterprise effort]]s undertaken in order to implement a [[proposed change]] when it is implemented. In other words, it is what the enterprise is going to lose as a result of the [[proposed change implementation]]. Because the cost likely depends on the [[payroll]] and the [[payroll]] depends on work time, a [[schedule estimate]] needs to be evaluated before the cost. Because the schedule likely depends on the work to be accomplished, a [[effort estimate]] needs to be evaluated before the schedule. Because the work definitely depends on the [[ | + | #'''[[Impact analysis]]'''. An assessment of the impact that a proposed change will have on a stakeholder or stakeholder group, project, or system. |

| − | #* | + | #*[[Political impact]]. Political advantages and disadvantages gained from the [[proposed change implementation]]. |

| − | #* | + | #*[[Economic impact]]. A profit gained from the [[proposed change implementation]]. |

| − | #* | + | #*[[Social impact]]. Social advantages and disadvantages gained from the [[proposed change implementation]]. |

| − | + | #*[[Technological impact]]. Technological advantages and disadvantages gained from the [[proposed change implementation]]. | |

| − | + | #'''[[Change cost estimate]]'''. The expected total cost of a set of [[enterprise effort]]s undertaken in order to implement a [[proposed change]] when it is implemented. This ''estimate'' is always approximated. In other words, it is what the enterprise is going to lose as a result of the [[proposed change implementation]]. Because the cost likely depends on the [[payroll]] and the [[payroll]] depends on the [[work time]], a [[schedule estimate]] needs to be evaluated before the cost. Because the schedule likely depends on the work to be accomplished, a [[effort estimate]] needs to be evaluated before the schedule. Because the work definitely depends on the [[change scope]], a [[change scope]] needs to be developed first of all. | |

| − | + | #*[[Change scope]]. All the features and functions that characterize a [[proposed change]]. | |

| − | #* | + | #*[[Effort estimate]]. The expected effort or work that needs to be accomplished to deliver a [[market exchangeable]] with the specified features and functions. |

| − | + | #*[[Life-cycle costing]]. The concept of including acquisition, operating, and disposal costs when evaluating various alternatives. | |

| − | + | #*[[Schedule estimate]]. The expected time of the delivery of a [[market exchangeable]] with the specified features and functions. | |

| − | |||

| − | |||

| − | |||

#'''[[Market analysis]]'''. Studies of the attractiveness, the risks, and the dynamics of the [[market]] that is identified by the analysis' buyer. Sometimes, [[market research]] is considered being the first phase of the [[market analysis]]. | #'''[[Market analysis]]'''. Studies of the attractiveness, the risks, and the dynamics of the [[market]] that is identified by the analysis' buyer. Sometimes, [[market research]] is considered being the first phase of the [[market analysis]]. | ||

| − | |||

#*[[Planned economy]]. An economic system in which economic decisions are planned by a central government. | #*[[Planned economy]]. An economic system in which economic decisions are planned by a central government. | ||

#*[[Free market economy]]. An economic system in which resources are primarily owned and controlled by the private sector. | #*[[Free market economy]]. An economic system in which resources are primarily owned and controlled by the private sector. | ||

| − | #*[[ | + | #*[[Valuation]]. The process by which a company's worth or value is determined. An analyst will look at capital structure, management team, and revenue or potential revenue, among other things. |

| − | # | + | #'''[[Estimate]]'''. An assessment of the likely quantitative result. Usually applied to project costs and durations and should always include some indication of accuracy (e.g., ±x percent). Usually used with a modifier (e.g., preliminary, conceptual, feasibility). Some application areas have specific modifiers that imply particular accuracy ranges (e.g., order-of-magnitude estimate, budget estimate, and definitive estimate in engineering and construction projects). |

| − | #* | + | #*[[Estimate at completion]] (EAC). The expected total cost of an activity, a group of activities, or the project when the defined scope of work has been completed. Most techniques for forecasting EAC include some adjustment of the original cost estimate, based on actual project performance to date. |

| − | #* | + | #*[[Estimate to complete]] (ETC). The expected additional cost needed to complete an activity, a group of activities, or the project. Most techniques for forecasting ETC include some adjustment to the original estimate, based on project performance to date. Also called "estimated to complete." See also earned value and estimate at completion. |

| − | # | + | #*[[Should-cost estimate]]. An estimate of the cost of a product or service used to provide an assessment of the reasonableness of a prospective contractor's proposed cost. |

| − | + | #*[[Percent complete]] (PC). An estimate, expressed as a percent, of the amount of work that has been completed on an activity or a group of activities. | |

| − | #*[[ | + | #'''[[Estimation]]'''. The process of assigning a quantifiable measure to the amount of workload needed to complete a project or task, in order to determine the duration, effort, or cost required to complete the project or task. |

| − | + | #*[[Relative estimation]]. One of several types of estimations Agile teams use to determine the amount of effort needed to complete project tasks. Tasks or user stories are compared against equivalent, previously completed tasks or group of tasks of similar difficulty. | |

| − | + | #*[[Planning poker]]. A team building exercise or game used to arrive at a group consensus for estimating workload based on the [[Delphi method]]. | |

| − | #'''[[ | ||

| − | #*[[ | ||

| − | #*[[ | ||

===Roles=== | ===Roles=== | ||

| − | |||

| − | |||

#'''[[Subject matter expert]]''' (SME). A stakeholder with specific expertise in an aspect of the problem domain or potential solution alternatives or components. | #'''[[Subject matter expert]]''' (SME). A stakeholder with specific expertise in an aspect of the problem domain or potential solution alternatives or components. | ||

#*[[Implementation subject matter expert]] (SME). A stakeholder who will be responsible for designing, developing, and implementing the change described in the requirements and have specialized knowledge regarding the construction of one or more solution components. | #*[[Implementation subject matter expert]] (SME). A stakeholder who will be responsible for designing, developing, and implementing the change described in the requirements and have specialized knowledge regarding the construction of one or more solution components. | ||

#*[[Domain subject matter expert]] (SME). A person with specific expertise in an area or domain under investigation. | #*[[Domain subject matter expert]] (SME). A person with specific expertise in an area or domain under investigation. | ||

| − | #'''[[Investor]]'''. | + | #'''[[Investor]]'''. An individual or [[enterprise]] that puts money into financial schemes, property, enterprise, etc. with the expectation of achieving a profit. |

| − | #*[[Angel investor]]. A private investor or group of private investors who offers financial backing to an [[entrepreneurial venture]] in return for equity in the venture. | + | #*[[Angel investor]]. A private investor or group of private investors who offers financial backing to an [[entrepreneurial venture]] in return for equity in the venture. Typically, [[angel investor]]s provide small amounts of [[Owner's Capital|capital]] at early stages of startup development, usually when it is in its infancy, and before a [[seed round]]. |

| − | + | #*[[Venture capitalist]]. An individual investor, who works for a venture capital firm and is authorized by it to professionally manage pools of investor money in order to invest in specific companies. [[Venture capitalist]]s typically have a focused market or sector that they know well and invest in. [[Venture capitalist]]s never or almost never invest in infant startups. | |

| − | + | #'''[[Cost estimator]]'''. An individual or enterprise that prepares cost estimates for product manufacturing, construction projects, or services to aid management in bidding on or determining price of product or service. He or she may specialize according to particular service performed or type of product manufactured. | |

| − | #*[[Venture capitalist]]. An individual investor, | ||

| − | #'''[[ | ||

===Methods=== | ===Methods=== | ||

| − | #'''[[Idea evaluation technique]]'''. An established procedure for | + | #'''[[Idea-evaluation technique]]'''. An established [[procedure]] for [[idea evaluation]]. |

#*[[Visual comparison]]. An [[idea evaluation technique]] that represents a comparison of two or more [[proposed idea]]s by eye. The ''ideas'' may be placed side by side, overlaid, or being dynamically alternated. This [[idea evaluation technique|technique]] also include a [[pairwise comparison]]. | #*[[Visual comparison]]. An [[idea evaluation technique]] that represents a comparison of two or more [[proposed idea]]s by eye. The ''ideas'' may be placed side by side, overlaid, or being dynamically alternated. This [[idea evaluation technique|technique]] also include a [[pairwise comparison]]. | ||

#*[[Scoring]]. An [[idea evaluation technique]] that encourages its participants to score [[proposed change]]s with one or more criteria in order to prioritize those ''changes''. This [[idea evaluation technique|technique]] also include the [[five star assessment]] and [[pass or fail test]]. Those techniques can be implemented in various ways, either online or onsite, including a simple or anonymous voting. | #*[[Scoring]]. An [[idea evaluation technique]] that encourages its participants to score [[proposed change]]s with one or more criteria in order to prioritize those ''changes''. This [[idea evaluation technique|technique]] also include the [[five star assessment]] and [[pass or fail test]]. Those techniques can be implemented in various ways, either online or onsite, including a simple or anonymous voting. | ||

| − | #*[[Proof of concept]]. Evidence, typically derived from an experiment or pilot project, which demonstrates that a design concept, business proposal, etc., is feasible. | + | #*[[Proof of concept]]. Evidence, typically derived from an [[experiment]] or [[pilot project]], which demonstrates that a design concept, business proposal, etc., is feasible. Many [[venture capitalist]]s require a demonstration of the feasibility of a concept or idea that a startup is based on in order to fund it. |

| − | |||

#'''[[Due diligence]]'''. An analysis an investor makes of all the facts and figures of a potential investment. Can include an investigation of financial records and a measure of potential ROI. | #'''[[Due diligence]]'''. An analysis an investor makes of all the facts and figures of a potential investment. Can include an investigation of financial records and a measure of potential ROI. | ||

#*[[ROI estimating]]. An [[idea evaluation technique]] that represents an attempt to expect the [[return on investment]] ([[return on investment|ROI]]) ratio for a [[proposed change]]. | #*[[ROI estimating]]. An [[idea evaluation technique]] that represents an attempt to expect the [[return on investment]] ([[return on investment|ROI]]) ratio for a [[proposed change]]. | ||

| − | |||

#*[[Funding]]. The act of providing financial resources, usually in the form of money, or other values such as effort or time, to finance a need, program, and project, usually by an [[organization]]. | #*[[Funding]]. The act of providing financial resources, usually in the form of money, or other values such as effort or time, to finance a need, program, and project, usually by an [[organization]]. | ||

#*[[Equity crowdfunding]]. The online offering of private company securities to a group of people for investment and therefore it is a part of the capital markets. | #*[[Equity crowdfunding]]. The online offering of private company securities to a group of people for investment and therefore it is a part of the capital markets. | ||

#*[[Venture capital]] (VC). Money provided by venture capital firms to small, high-risk, startup companies with major growth potential. | #*[[Venture capital]] (VC). Money provided by venture capital firms to small, high-risk, startup companies with major growth potential. | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

#'''[[Assumptions analysis]]'''. A technique that explores the [[assumption]]s' accuracy and identifies risks to the project from inaccuracy, inconsistency, or incompleteness of [[assumption]]s. | #'''[[Assumptions analysis]]'''. A technique that explores the [[assumption]]s' accuracy and identifies risks to the project from inaccuracy, inconsistency, or incompleteness of [[assumption]]s. | ||

| − | #*[[Assumption]]. | + | #*[[Assumption]]. An [[environment factor]] that is believed to be true, real, or certain, but have not been confirmed to be accurate. While being simplified for early planning purposes, [[assumption]]s may be considered to be true without questioning. At the same time, [[assumption]]s generally involve a degree of [[risk]]. For risk identification, [[assumption]]s may be questioned. In [[project management]], [[assumption]]s affect all aspects of project planning, and are part of the progressive elaboration of the project. Project teams frequently identify, document, and validate assumptions as part of their planning process. |

#'''[[Force field analysis]]'''. A graphical method for depicting the forces that support and oppose a [[proposed change]]. Involves identifying the forces, depicting them on opposite sides of a line (supporting and opposing forces) and then estimating the strength of each set of forces. | #'''[[Force field analysis]]'''. A graphical method for depicting the forces that support and oppose a [[proposed change]]. Involves identifying the forces, depicting them on opposite sides of a line (supporting and opposing forces) and then estimating the strength of each set of forces. | ||

===Instruments=== | ===Instruments=== | ||

| − | + | #'''[[Idea evaluation tool]]'''. A tangible and/or software implement used to evaluate [[concept]]s. | |

| − | #'''[[Idea evaluation tool]]'''. A tangible or software implement used to | ||

#*[[Pros and cons table]]. An [[idea evaluation tool]] that usually represents two columns, one of the advantages called "pros" and another for disadvantages called "cons." | #*[[Pros and cons table]]. An [[idea evaluation tool]] that usually represents two columns, one of the advantages called "pros" and another for disadvantages called "cons." | ||

#*[[What if question]]. An [[idea evaluation tool|idea]] and [[risk evaluation tool]] that encourages asking "What if?" while evaluating an [[idea]]. | #*[[What if question]]. An [[idea evaluation tool|idea]] and [[risk evaluation tool]] that encourages asking "What if?" while evaluating an [[idea]]. | ||

#*[[Should we question]]. An [[idea evaluation tool]] that encourages asking "Should we?" while evaluating an [[idea]]. | #*[[Should we question]]. An [[idea evaluation tool]] that encourages asking "Should we?" while evaluating an [[idea]]. | ||

| − | #'''[[Gantt chart]]'''. A [[project tool]] that represents actual and planned output over a period of time. In other words, it is a graphic display of schedule-related information. In the typical [[Gantt chart]], activities or other project elements are listed down the left side of the chart, dates are shown across the top, and activity durations are shown as date-placed horizontal bars. The chart was initially developed by [[Henry Gantt]] | + | #'''[[Affinity diagram]]''' (or [[affinity diagramming]]). A business tool used to organise a large number of ideas, sorting them into groups based on their natural relationships, for review and analysis. |

| − | + | #'''[[Gantt chart]]'''. A [[project management tool]] that represents actual and planned output over a period of time. In other words, it is a graphic display of schedule-related information. In the typical [[Gantt chart]], activities or other project elements are listed down the left side of the chart, dates are shown across the top, and activity durations are shown as date-placed horizontal bars. Any bar shows the start and finish dates of the activity it represents. The ''chart'' was initially developed by [[Henry Gantt]]. | |

| − | #*[[Load chart]]. A modified [[Gantt chart]] that schedules capacity by entire departments or specific resources. | + | #*[[Load chart]]. A modified [[Gantt chart]] that schedules [[capacity]] by entire departments or specific resources. |

| − | #'''[[ | + | #[[File:Swot.png|400px|thumb|right|[[SWOT analysis]]]]'''[[SWOT analysis]]'''. A tool that maps analyses of the [[enterprise environment]]. SWOT is an acronym for [[strength|'''s'''trength]]s, [[weakness|'''w'''eakness]]es, [[opportunity|'''o'''pportuniti]]es, and [[threat|'''t'''hreat]]s. |

| − | + | #*[[Strength]]. Any activity the organization does well or its unique resource. | |

| − | #* | + | #*[[Weakness]]. An activity the organization does not do well or a resource it needs but does not possess. |

| − | #* | + | #*[[Opportunity]]. A positive trend in the [[enterprise environment]]. |

| − | #* | + | #*[[Threat]]. A negative trend in the [[enterprise environment]]. |

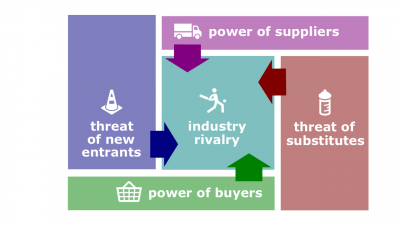

| − | #* | + | #[[File:Porter-forces.png|400px|thumb|right|[[Porter's five forces framework]]]]'''[[Porter's five forces framework]]'''. A tool that maps analyses of competition of a [[business]]. The five forces include (a) threat of new entrants, (b) threat of substitutes, (c) bargaining power of customers, (d) bargaining power of suppliers, and (e) industry rivalry. |

| − | # | ||

| − | |||

| − | |||

| − | |||

===Results=== | ===Results=== | ||

| − | *[[Business case]]. An assessment of the costs and benefits associated with a proposed initiative. | + | #'''[[Feasible idea]]''' (or [[feasible alternative]]). Reviews of available alternate procurement actions which could attain the objectives. |

| + | #*[[Verified idea]] (or [[verified alternative]]). | ||

| + | #*[[Validated idea]] (or [[validated alternative]]). | ||

| + | #'''[[Business case]]'''. An assessment of the costs and benefits associated with a proposed initiative. | ||

===Practices=== | ===Practices=== | ||

#Methods and instruments used for [[stakeholder engagement]] can be always or nearly always applied to [[change support analysis]]. | #Methods and instruments used for [[stakeholder engagement]] can be always or nearly always applied to [[change support analysis]]. | ||

| − | #Some researches agree that the [[SWOT | + | #Some researches agree that the [[SWOT analysis]] shall be outsourced if an enterprise decides to employ it. [[Porter's five forces framework]] initially indented to better map the [[enterprise environment]]. |

| − | '' | + | ''[[Enterprise Architecture Quarter]] is the successor lecture. In the [[enterprise research]] series, the next lecture is [[Business Analysis Quarter]].'' |

==Materials== | ==Materials== | ||

| Line 145: | Line 113: | ||

==See also== | ==See also== | ||

| + | |||

| + | [[Category:Septem Artes Administrativi]][[Category:Lecture notes]] | ||

Latest revision as of 19:24, 13 June 2023

Feasibility Study Quarter (hereinafter, the Quarter) is a lecture introducing the learners to portfolio research primarily through key topics related to feasibility study. The Quarter is the second of four lectures of Portfolio Quadrivium, which is the first of seven modules of Septem Artes Administrativi (hereinafter, the Course). The Course is designed to introduce the learners to general concepts in business administration, management, and organizational behavior.

Contents

Outline

Idea Generation Quarter is the predecessor lecture. In the enterprise discovery series, the previous lecture is Bookkeeping Quarter.

- Portfolio research is the enterprise research of data needed to design and/or modify the enterprise portfolio. Organizationally, the data needed to design or modify these market exchangeables is collected through idea generation, validated learning, monitoring, and market intercourses. This particular lecture concentrates on validated learning because these enterprise efforts are the primary method for collecting data that emerges as a result of product developments. This lecture concentrates on feasibility study of proposed changes because the data collected from operational businesses is researched through controlling.

Concepts

- Feasibility study. In enterprise administration, an assessment of the practical potential of a proposed change. Depending on the nature of the proposed change and the complexity of its implementation, this assessment may consist of one or more evaluations; a feasibility study may also not be feasible itself. Feasibility study can also be described as an evaluation of proposed alternatives to determine if they are legally and technically possible within the constraints of the enterprise and whether they will deliver the desired benefits to the enterprise.

- Proposed change. Any change that is proposed in order to be implemented.

- Proposed change implementation. A project undertaken in order to implement the proposed change.

- Change. In enterprise administration, the act or instance of becoming different and/or doing business differently.

- Unexpected change. Change activities that are unintentional and not necessarily goal oriented.

- Planned change. Change activities that are intentional and goal oriented.

- Idea evaluation. An appraisal of potential solutions to problems to identify the best one.

- Evaluation. The systematic and objective assessment of a solution to determine its status and efficacy in meeting objectives over time, and to identify ways to improve the solution to better meet objectives. See also metric, indicator and monitoring.

- Domain. The problem area undergoing analysis.

- Opportunity analysis. The process of examining new business opportunities to improve organizational performance.

- Social screening. Approving social criteria (screens) to investment decisions.

- Enterprise environment. (1) The surroundings or conditions in which an enterprise operates; (2) The combined internal and external factors and forces, both standing alone and interacting with one another, that affect or can potentially affect the enterprise's performance.

- Structured environment (or controlled environment). A certain, predictable environment under one's control.

- Unstructured environment. An uncertain, unpredictable environment with unknown or no structure.

- Internal environment. (1) Those factors and forces inside of somebody or something that affect or can potentially affect his, her, or its performance; (2) Enterprise environment within the borders of the enterprise.

- External environment. (1) Those factors and forces outside of somebody or something that affect or can potentially affect his, her, or its performance; (2) Enterprise environment beyond the borders of the enterprise.

- Environment characteristic. Any distinguishing trait, quality, or property of the environment.

- Enterprise environmental complexity. The number of components in an enterprise's environment and the extent of the enterprise's knowledge about its components.

- Enterprise environmental uncertainty. The degree of change and complexity in an enterprise's environment.

- Change readiness assessment. An assessment that describes whether stakeholders are prepared to accept the change associated with a solution and are able to use it effectively.

- Business capability. A function of an organization that enables it to achieve a business goal or objective.

- Compliance feasibility. An assessment of how the proposed change would conflict with legal, corporate, and other mandated requirements.

- Integration feasibility. An assessment of how the proposed change would conflict with existing systems that the enterprise already employs.

- Cost-benefit analysis. An analysis of the difference between the change benefit estimate, which is what the enterprise is going to obtain, and change cost estimate, which is what the enterprise is going to lose when some proposed change is implemented. In other words, the financial and non-financial costs of making a change or implementing a solution are compared and quantified to the benefits gained during this analysis. Usually, the cost-benefit analysis is the core of feasibility study.

- Change benefit estimate. The difference between the positive and negative impacts of the proposed change. The positive impact can be assessed as the expected total value that the enterprise is going to obtain after a proposed change is implemented. The negative impact is what the enterprise is going to lose. These estimates may have several components and may be obtained as a result of an impact analysis.

- Impact analysis. An assessment of the impact that a proposed change will have on a stakeholder or stakeholder group, project, or system.

- Political impact. Political advantages and disadvantages gained from the proposed change implementation.

- Economic impact. A profit gained from the proposed change implementation.

- Social impact. Social advantages and disadvantages gained from the proposed change implementation.

- Technological impact. Technological advantages and disadvantages gained from the proposed change implementation.

- Change cost estimate. The expected total cost of a set of enterprise efforts undertaken in order to implement a proposed change when it is implemented. This estimate is always approximated. In other words, it is what the enterprise is going to lose as a result of the proposed change implementation. Because the cost likely depends on the payroll and the payroll depends on the work time, a schedule estimate needs to be evaluated before the cost. Because the schedule likely depends on the work to be accomplished, a effort estimate needs to be evaluated before the schedule. Because the work definitely depends on the change scope, a change scope needs to be developed first of all.

- Change scope. All the features and functions that characterize a proposed change.

- Effort estimate. The expected effort or work that needs to be accomplished to deliver a market exchangeable with the specified features and functions.

- Life-cycle costing. The concept of including acquisition, operating, and disposal costs when evaluating various alternatives.

- Schedule estimate. The expected time of the delivery of a market exchangeable with the specified features and functions.

- Market analysis. Studies of the attractiveness, the risks, and the dynamics of the market that is identified by the analysis' buyer. Sometimes, market research is considered being the first phase of the market analysis.

- Planned economy. An economic system in which economic decisions are planned by a central government.

- Free market economy. An economic system in which resources are primarily owned and controlled by the private sector.

- Valuation. The process by which a company's worth or value is determined. An analyst will look at capital structure, management team, and revenue or potential revenue, among other things.

- Estimate. An assessment of the likely quantitative result. Usually applied to project costs and durations and should always include some indication of accuracy (e.g., ±x percent). Usually used with a modifier (e.g., preliminary, conceptual, feasibility). Some application areas have specific modifiers that imply particular accuracy ranges (e.g., order-of-magnitude estimate, budget estimate, and definitive estimate in engineering and construction projects).

- Estimate at completion (EAC). The expected total cost of an activity, a group of activities, or the project when the defined scope of work has been completed. Most techniques for forecasting EAC include some adjustment of the original cost estimate, based on actual project performance to date.

- Estimate to complete (ETC). The expected additional cost needed to complete an activity, a group of activities, or the project. Most techniques for forecasting ETC include some adjustment to the original estimate, based on project performance to date. Also called "estimated to complete." See also earned value and estimate at completion.

- Should-cost estimate. An estimate of the cost of a product or service used to provide an assessment of the reasonableness of a prospective contractor's proposed cost.

- Percent complete (PC). An estimate, expressed as a percent, of the amount of work that has been completed on an activity or a group of activities.

- Estimation. The process of assigning a quantifiable measure to the amount of workload needed to complete a project or task, in order to determine the duration, effort, or cost required to complete the project or task.

- Relative estimation. One of several types of estimations Agile teams use to determine the amount of effort needed to complete project tasks. Tasks or user stories are compared against equivalent, previously completed tasks or group of tasks of similar difficulty.

- Planning poker. A team building exercise or game used to arrive at a group consensus for estimating workload based on the Delphi method.

Roles

- Subject matter expert (SME). A stakeholder with specific expertise in an aspect of the problem domain or potential solution alternatives or components.

- Implementation subject matter expert (SME). A stakeholder who will be responsible for designing, developing, and implementing the change described in the requirements and have specialized knowledge regarding the construction of one or more solution components.

- Domain subject matter expert (SME). A person with specific expertise in an area or domain under investigation.

- Investor. An individual or enterprise that puts money into financial schemes, property, enterprise, etc. with the expectation of achieving a profit.

- Angel investor. A private investor or group of private investors who offers financial backing to an entrepreneurial venture in return for equity in the venture. Typically, angel investors provide small amounts of capital at early stages of startup development, usually when it is in its infancy, and before a seed round.

- Venture capitalist. An individual investor, who works for a venture capital firm and is authorized by it to professionally manage pools of investor money in order to invest in specific companies. Venture capitalists typically have a focused market or sector that they know well and invest in. Venture capitalists never or almost never invest in infant startups.

- Cost estimator. An individual or enterprise that prepares cost estimates for product manufacturing, construction projects, or services to aid management in bidding on or determining price of product or service. He or she may specialize according to particular service performed or type of product manufactured.

Methods

- Idea-evaluation technique. An established procedure for idea evaluation.

- Visual comparison. An idea evaluation technique that represents a comparison of two or more proposed ideas by eye. The ideas may be placed side by side, overlaid, or being dynamically alternated. This technique also include a pairwise comparison.

- Scoring. An idea evaluation technique that encourages its participants to score proposed changes with one or more criteria in order to prioritize those changes. This technique also include the five star assessment and pass or fail test. Those techniques can be implemented in various ways, either online or onsite, including a simple or anonymous voting.

- Proof of concept. Evidence, typically derived from an experiment or pilot project, which demonstrates that a design concept, business proposal, etc., is feasible. Many venture capitalists require a demonstration of the feasibility of a concept or idea that a startup is based on in order to fund it.

- Due diligence. An analysis an investor makes of all the facts and figures of a potential investment. Can include an investigation of financial records and a measure of potential ROI.

- ROI estimating. An idea evaluation technique that represents an attempt to expect the return on investment (ROI) ratio for a proposed change.

- Funding. The act of providing financial resources, usually in the form of money, or other values such as effort or time, to finance a need, program, and project, usually by an organization.

- Equity crowdfunding. The online offering of private company securities to a group of people for investment and therefore it is a part of the capital markets.

- Venture capital (VC). Money provided by venture capital firms to small, high-risk, startup companies with major growth potential.

- Assumptions analysis. A technique that explores the assumptions' accuracy and identifies risks to the project from inaccuracy, inconsistency, or incompleteness of assumptions.

- Assumption. An environment factor that is believed to be true, real, or certain, but have not been confirmed to be accurate. While being simplified for early planning purposes, assumptions may be considered to be true without questioning. At the same time, assumptions generally involve a degree of risk. For risk identification, assumptions may be questioned. In project management, assumptions affect all aspects of project planning, and are part of the progressive elaboration of the project. Project teams frequently identify, document, and validate assumptions as part of their planning process.

- Force field analysis. A graphical method for depicting the forces that support and oppose a proposed change. Involves identifying the forces, depicting them on opposite sides of a line (supporting and opposing forces) and then estimating the strength of each set of forces.

Instruments

- Idea evaluation tool. A tangible and/or software implement used to evaluate concepts.

- Pros and cons table. An idea evaluation tool that usually represents two columns, one of the advantages called "pros" and another for disadvantages called "cons."

- What if question. An idea and risk evaluation tool that encourages asking "What if?" while evaluating an idea.

- Should we question. An idea evaluation tool that encourages asking "Should we?" while evaluating an idea.

- Affinity diagram (or affinity diagramming). A business tool used to organise a large number of ideas, sorting them into groups based on their natural relationships, for review and analysis.

- Gantt chart. A project management tool that represents actual and planned output over a period of time. In other words, it is a graphic display of schedule-related information. In the typical Gantt chart, activities or other project elements are listed down the left side of the chart, dates are shown across the top, and activity durations are shown as date-placed horizontal bars. Any bar shows the start and finish dates of the activity it represents. The chart was initially developed by Henry Gantt.

- Load chart. A modified Gantt chart that schedules capacity by entire departments or specific resources.

- SWOT analysis. A tool that maps analyses of the enterprise environment. SWOT is an acronym for strengths, weaknesses, opportunities, and threats.

- Strength. Any activity the organization does well or its unique resource.

- Weakness. An activity the organization does not do well or a resource it needs but does not possess.

- Opportunity. A positive trend in the enterprise environment.

- Threat. A negative trend in the enterprise environment.

- Porter's five forces framework. A tool that maps analyses of competition of a business. The five forces include (a) threat of new entrants, (b) threat of substitutes, (c) bargaining power of customers, (d) bargaining power of suppliers, and (e) industry rivalry.

Results

- Feasible idea (or feasible alternative). Reviews of available alternate procurement actions which could attain the objectives.

- Business case. An assessment of the costs and benefits associated with a proposed initiative.

Practices

- Methods and instruments used for stakeholder engagement can be always or nearly always applied to change support analysis.

- Some researches agree that the SWOT analysis shall be outsourced if an enterprise decides to employ it. Porter's five forces framework initially indented to better map the enterprise environment.

Enterprise Architecture Quarter is the successor lecture. In the enterprise research series, the next lecture is Business Analysis Quarter.